Subscription success at the FT depends less on how often readers click and more on what they can afford. The Big Mac comparison reveals why disposable income and local cost of living influence conversion rates.

-

James Laird-Smith

In recent years, subscription-based reader revenue models have become the norm for news media organisations. We’re now seeing deep thinking applied to different pricing models - particularly cut-price trials - and how they can drive long-term subscriber growth.

Once readers are trialling a subscription, how can we develop a clear picture of what they are like, how they’re interacting with the product, and most importantly, what factors influence whether a trialist is likely to convert?

From maximising returns on marketing spend by targeting those with the highest propensity to convert, to giving direction when moving into a new market or territory. This level of insight from an audience can have a significant impact on optimising a subscription model.

Today we hear from James Laird-Smith, Customer Analytics Analyst here at the FT, to understand how the business got a better understanding of which factors truly matter when getting trialists to convert to long-term users, and how a certain fast-food burger informed his thinking around this.

*Some FT reader data has been anonymised.

Why is it important to understand the behaviour of trialists?

Most new FT.com subscribers arrive at their subscription from a trial, which gives them digital access to the Financial Times for just £1.

Our understanding of these trialists used to be relatively limited. There was no actual way for us to understand segmentation or propensity to convert. This meant it was difficult for other teams to know who to target and what to focus on from a product perspective.

What were some of the initial hypotheses at the outset of the project?

We assumed that trialists who engaged frequently with our products would be strongly correlated with those converting to paid subscribers. The rationale being: a reader who is demonstrating that they’re getting value from the trial by consuming lots of content will be more likely to commit long-term to the FT.

We set out to measure the conversion rate from trialist to paying subscriber among the following segments of trialists:

- Those trialists who visited throughout the trial were measured by the number of days with page views.

- Those whose usage started strong and then trailed off.

- Those who visited on day 1 of their trial and then cancelled on the last day.

What was the outcome of this?

We thought we might observe significant differences in behaviour between these segments and the overall population, but we didn’t actually identify any notable findings:

The chart shows the different colours for whether the users converted or not. As we see, they are evenly split, regardless of level of engagement.

Although we identified there were some engagement-related drivers, such as how widely they read or whether they used the app, these had only a moderate impact on conversion rates. It wasn’t worth digging much deeper.

This is where it’s really key to keep in mind that some variables might be more important than others, regardless of prior assumptions about your audience.

Did you notice anything that really moved the needle?

Above all other factors, the key driver of conversion is income.

In real terms, the impact of an FT subscription (£X-£) on a reader’s disposable income is key to understanding whether they convert from the trial. The likes of Warren Buffett aren't going to feel the same pinch on their monthly expenditure as a second-year Economics student, for example.

But readers don’t disclose their income to the FT. How did you estimate it?

That is correct, but one thing we do ask of them, which fits naturally into the business-centric mindset of our readership, is job title. It’s far from a perfect science, but we’re able to make some informed estimations of income based on job titles, as well as segment readers into cohorts.

Here we see the conversion rate by work position mapped:

Was income seen to be a universal predictor?

Once we noticed income made a significant impact on the conversion rate of trialists, I decided it’d be worth digging further into it, to see if there were any additional nuances to the correlation.

The next natural question, given the global readership of the FT, was location.

Something really apparent to me, having grown up in South Africa, is the seismic geographical differences in purchasing power. Even after accounting for exchange rates, things simply cost less in other countries. The same basket of goods in Europe can be half the price in South Africa.

This meant it was key to examine the purchasing power of FT trialists, allowing us to deepen our understanding of income.

How did you go about measuring these geographical differences?

There are some well-established metrics for this, such as using the IMF or World Bank indices, but these can be cumbersome and difficult to handle.

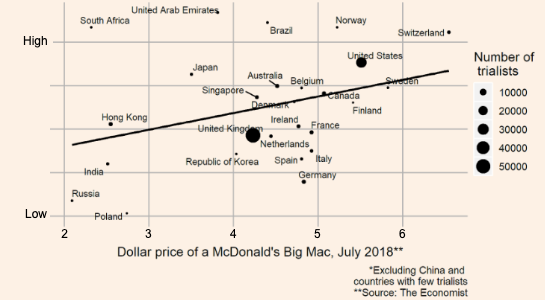

But a really simple, powerful alternative is the Big Mac Index. It is a survey created and run by The Economist magazine since 1986 as an informal way of measuring the purchasing power of currencies around the world, using the McDonald’s Big Mac as the benchmark. The virtue of using the Big Mac is that it’s a standardised product: just like the FT, it is the same regardless of where you consume it.

Did you find that conversion rates correlated with a higher Big Mac Index?

Yes absolutely! If you look at the conversion rates across countries, you can see that countries like Sweden, where purchasing power is high, also have a high conversion rate.

On the other hand, in the likes of Poland or Russia, where the Big Mac Index is low, we see a low conversion rate.

In instances like these, when the conversion rate is impacted far more on the profile of the trialist themselves, rather than their engagement with the product, it allows organisations to focus efforts on the things that really matter.

Without a true understanding of key audience variables - backed by data, rather than pure assumptions, activities across product, marketing and even editorial can be wasted on trying to influence variables which don’t drive the behaviours needed to influence key commercial objectives.

A full understanding of the most influential factors in a trialist’s propensity to subscribe allowed the FT to take a much more proactive role in driving subscriptions: from setting up a phone call scheme to those seen as most likely to convert, to allowing the US Growth team to get a rapid understanding of who their ideal customer profile was as they launched into a new market.

And interestingly, the more expensive a burger is in your local McDonalds, the more likely you are to see a copy of the Financial Times.

-1.png?width=768&name=Hero%20Image%20(3)-1.png)