Why is retention top of mind for business leaders in 2023? The answer is simple: a retained customer is the most valuable of them all

Every CEO and business leader we are talking with at the start of this new year has one thing on their mind: Retention.

We see this not only through the types of questions our clients are coming to us with, but also in industry wide reports and research. In the most recent Reuters Institute Journalism, Media, and Technology Trends Predictions Report (2023), Nic Newman highlights that of the 303 News/Publishing leaders from 53 countries and territories surveyed, “The consensus is that this year will be more focused on the retention of existing subscribers, rather than adding new ones.”

We also found this to be true in a report we have recently conducted in collaboration with Minna Technologies and Savanta. In a Subscription Economy: A Transformed World, we conducted exclusive research and insights into the subscription habits of 2,000 UK and US consumers, as well as surveyed 50 subscription business leaders across industries on their strategy. What we found is that “Almost seven in ten (68%) of the 50 leading subscription businesses we surveyed say that retention is their top strategic priority”.

This article will help explain why retention is so important by using insights from our report and beyond, as well as highlight some tactics that your business can think of to help with retention.

Why is retention top of mind? Because consumers are more aware of what they are spending their money on

With the pandemic and successive lockdowns, consumers have been spending more on subscriptions as they have been forced to new ways of buying goods and services, with our research finding all group ages spending net more on subscriptions compared to 2021.

Yet, with the twin realities of inflation and high energy prices hitting households, the report also found that one in three (37%) consumers have cancelled a service in the last six months, and a slightly higher proportion (42%) saying they are likely to do so in the next six months. This is driven by almost all respondents (93%) declaring a higher awareness on the amount they are spending on subscriptions compared to 12 months ago. In addition, driven by 18-24 year olds, we found that consumers are using subscriptions more flexibly, switching them on and off, as needed, and often returning to brands within months of cancelling subscriptions.

With consumers being more aware of what they spend, businesses will increasingly require placing greater emphasis on optimising customer retention, putting it at the forefront rather than acquisition strategies.

Retention strategies are more important than pure-play acquisition

The illustrative graph below can help prove the point to why retaining a customer is crucial to profits. The typical cash flow profile of a B2C subscriber showcases that the most profitable period is the one after year 1, where acquisition and support costs significantly lower and cash from sales grows as does the LTV of the subscriber. A study to help prove this point is this research paper by Frederick Reichheld of Bain & Company (the inventor of the net promoter score) which shows that increasing customer retention rates by 5% increases profits by somewhere from 25% to 95%.

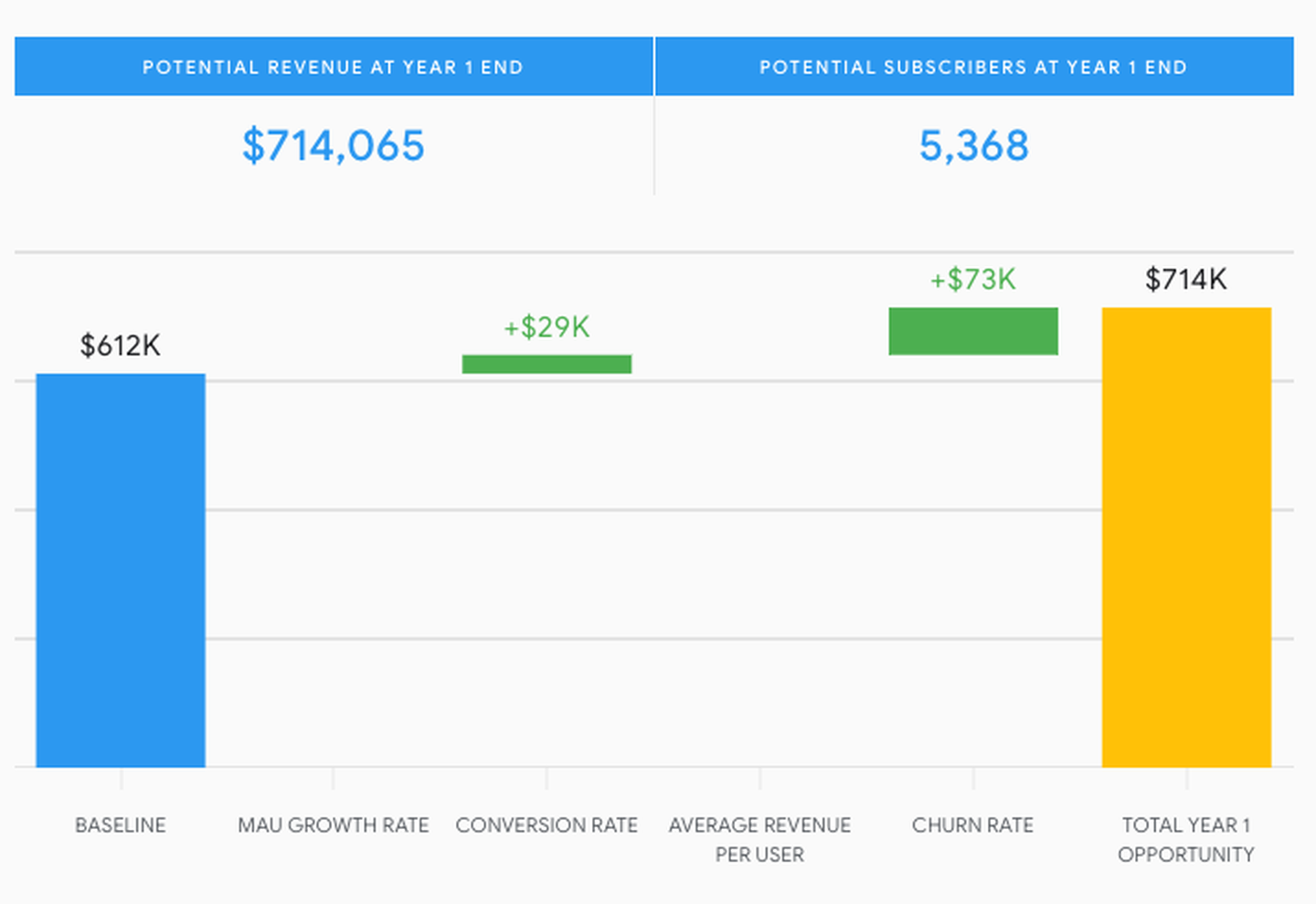

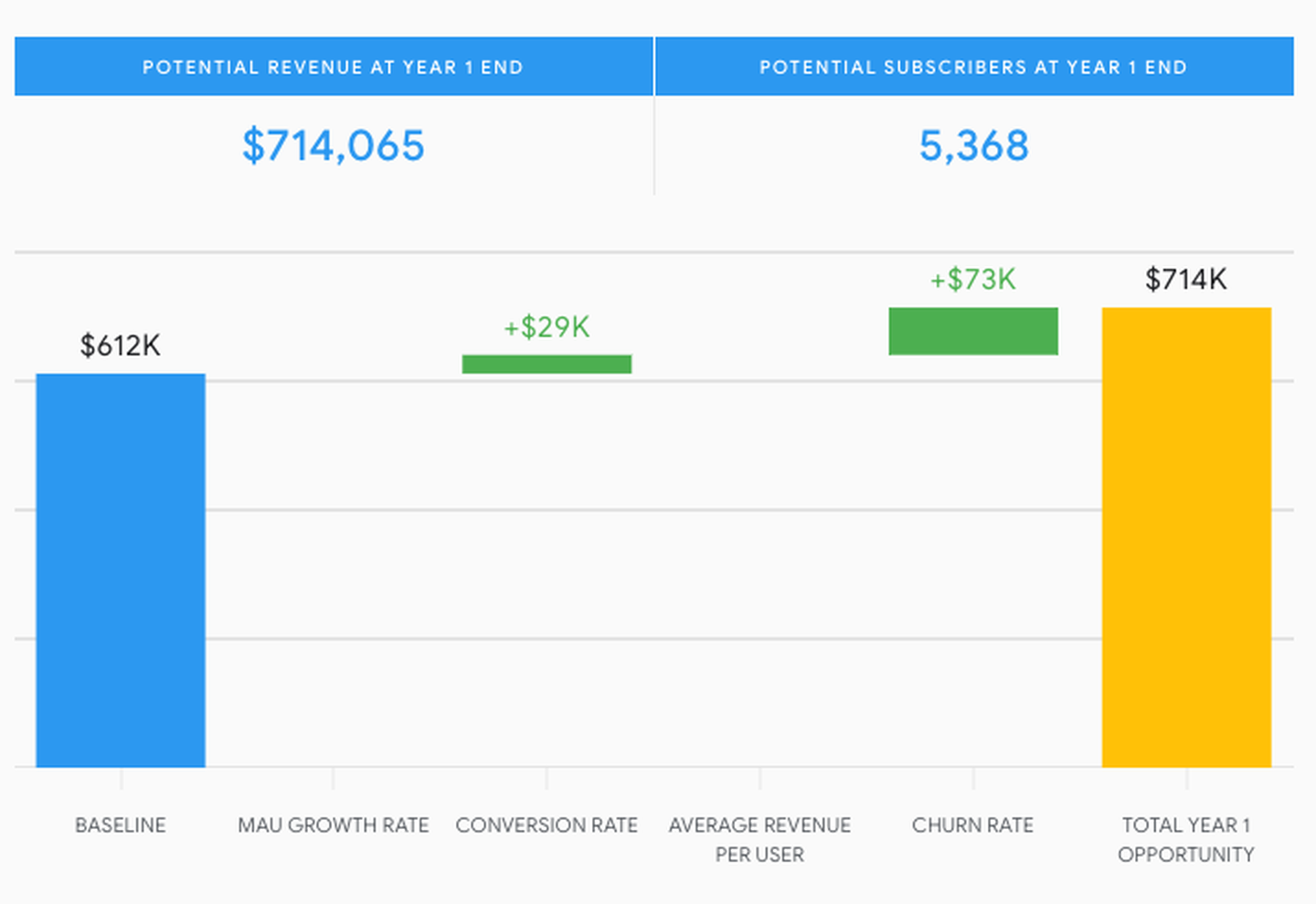

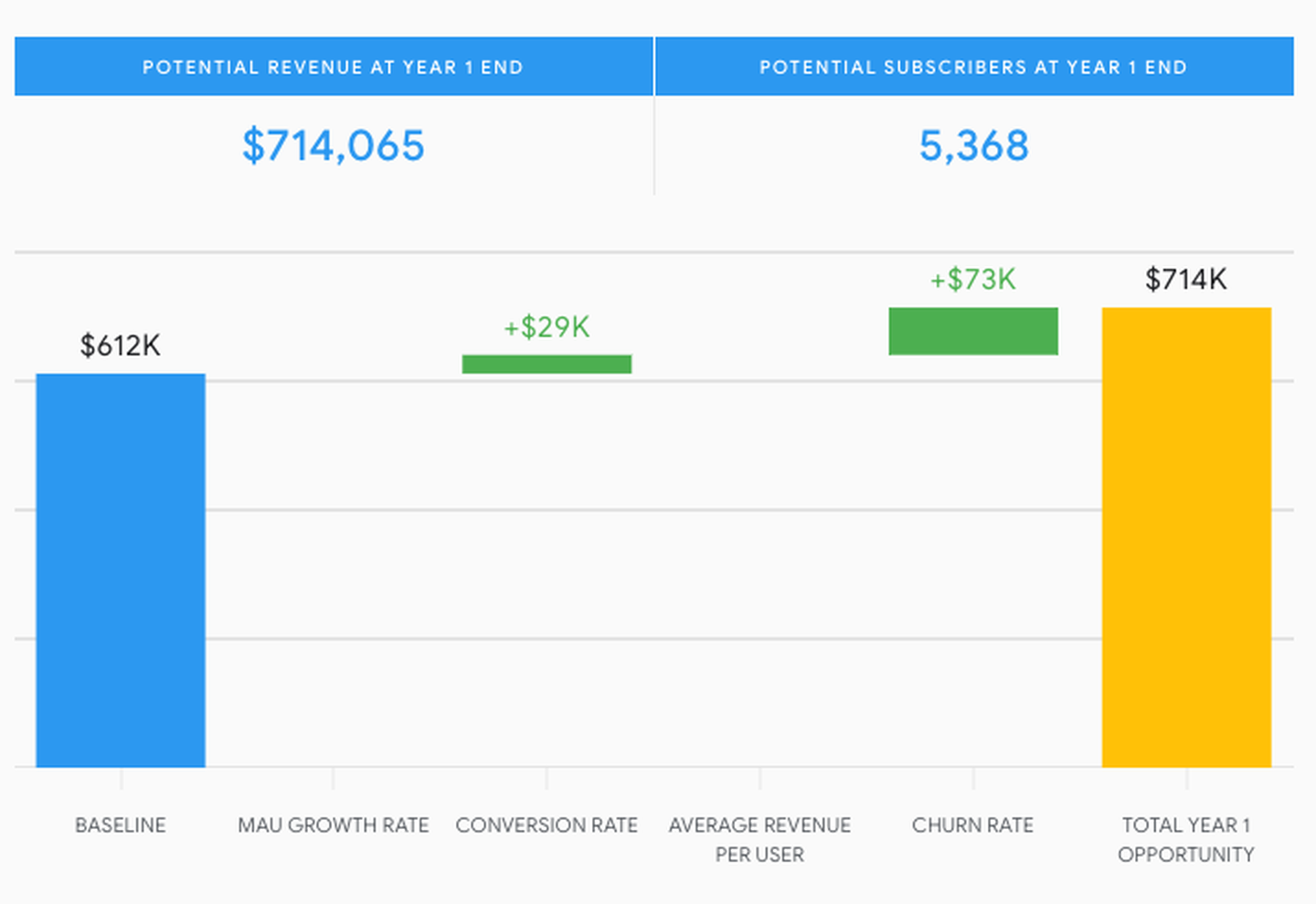

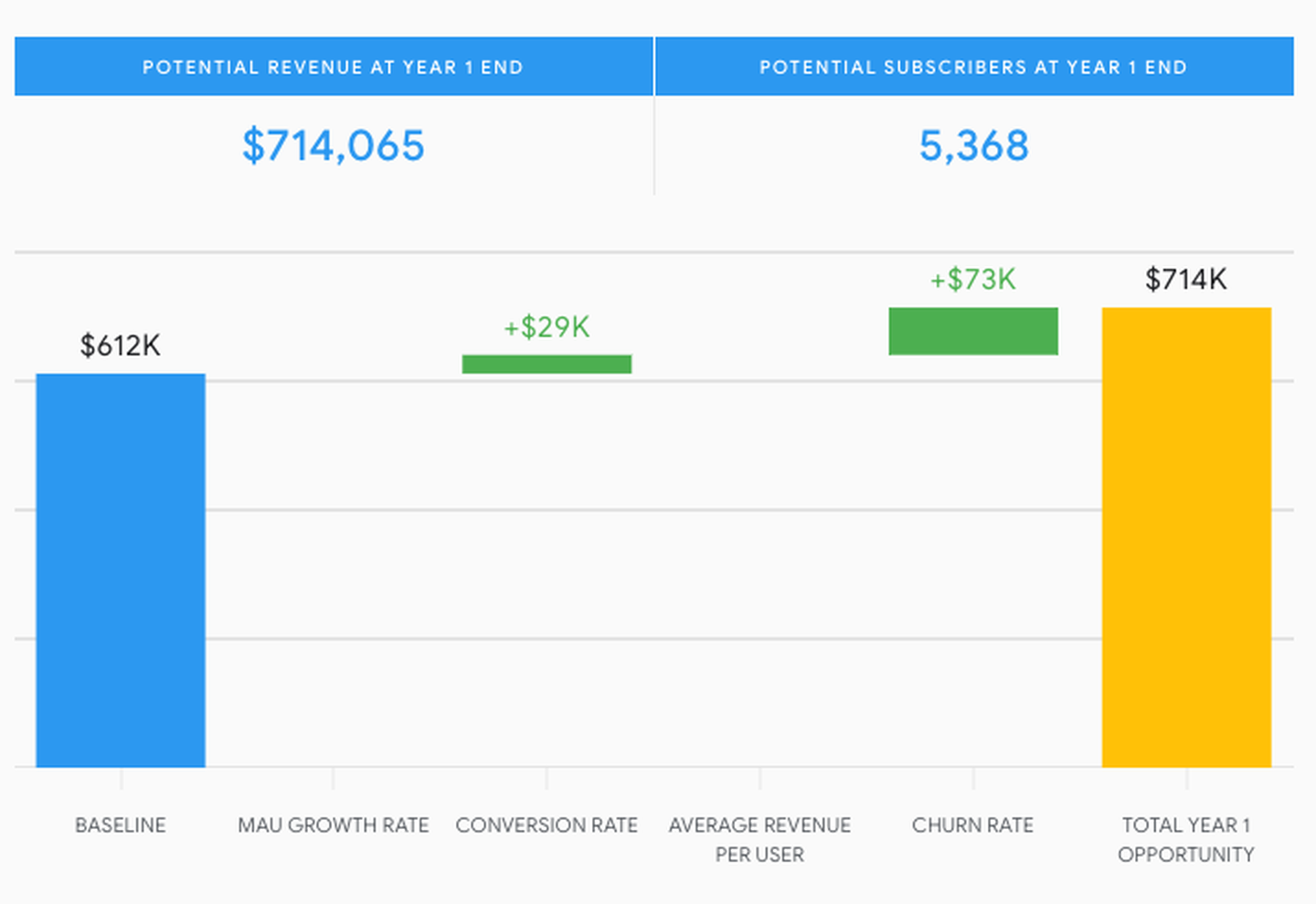

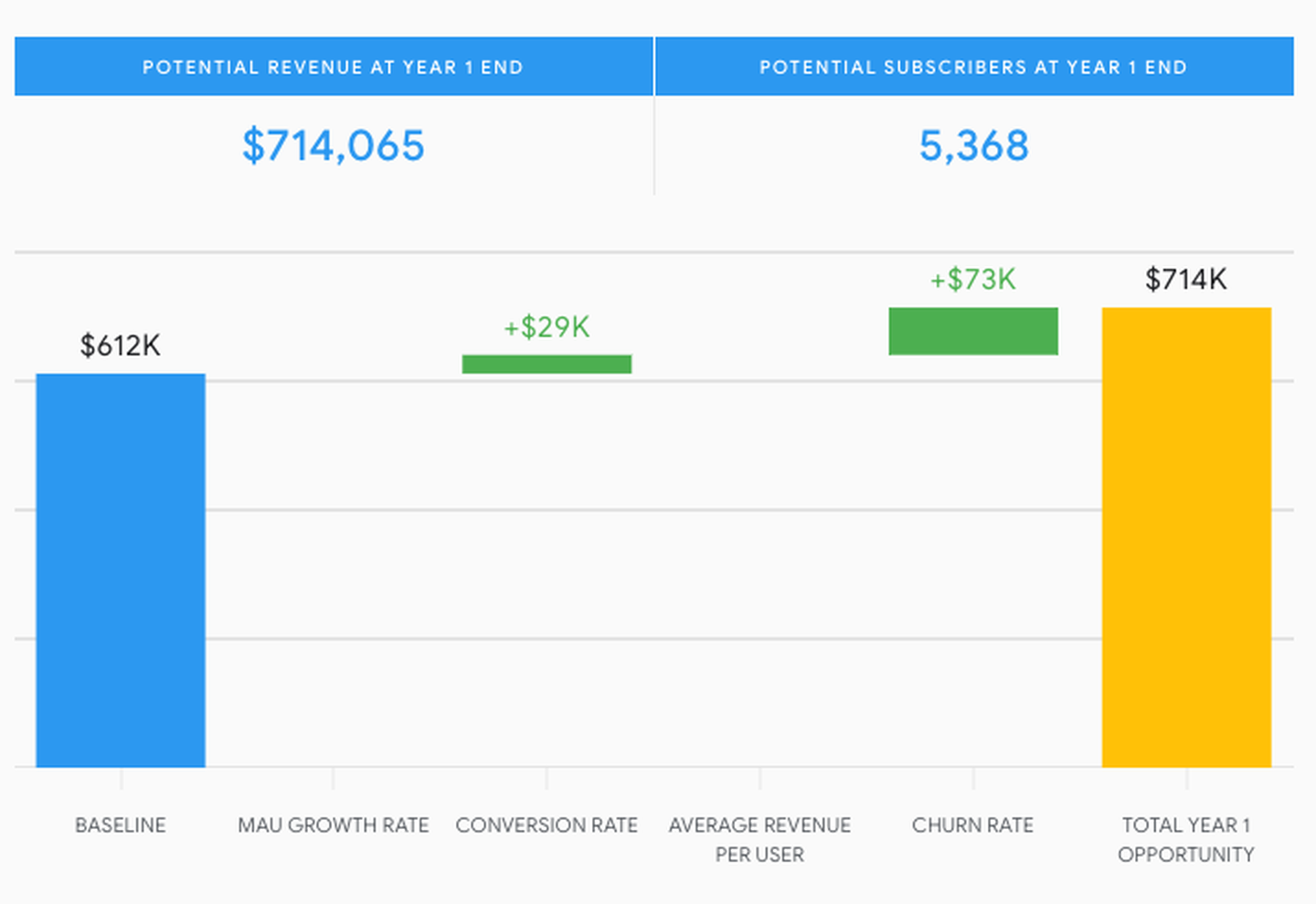

In fact, reducing your businesses' churn ever so slightly can have a substantial increase in lifetime value. Online calculators such as the one in the Reader Revenue GNI playbook on Exercise 1 or the OMNI calculator for businesses outside of publishing, are useful tools to see this in numbers. Let’s take an example of a fictitious publishing company that has:

- 10k Monthly Active Users (MAUs)

- Monthly conversion rate of 4%

- ARPU of 10$

- Monthly Churn rate of 10%

While keeping ARPU and MAUs constant, an improvement to the conversion rate by 2 points to 6% would help grow revenue by $29k within a year, while decreasing the churn rate by 2 ppts to 8% can help deliver $73k, almost triple the value.

Thinking of the customer lifecycle can help you better optimise your retention strategy

Now that we’ve explained the importance of retention, here are some of the tactics that the FT uses throughout a customer’s lifecycle that could be useful for your business.

1. Early Life

Industry research from Piano finds that up to a third of all active churn happens within the first 24 hours of subscription, meaning new subscribers are particularly at high risk of leaving and are therefore key segments to direct retention focused strategy.

To help mitigate this and showcase immediate value to new subscribers, a clear onboarding journey is paramount. At the FT, depending on what the subscriber has read and what features they used before subscribing, our onboarding journey will promote and showcase different long-term habit-forming features such as introducing a niche newsletter vertical, a guide to how to use the personalised MyFT page, as well as acknowledge the use of new features to promote their usage (eg: You’ve just saved X topic, you could also be interested in Y).

2. In life

Throughout the customer lifecycle between two renewal periods, it is key to keep track of how users are engaging with your product and stay on top of their habits to help proactively ‘rightsize’ them. The FT for example proactively moves subscribers that are “likely to churn” to a lower price point and a package that reflects their needs. This acts as a mechanism to “surprise and delight” subscribers prior to the point of renewal and also provides an opportunity to transition them onto higher retention products or tenures.

In his 2023 Journalism Prediction Report, Nic Newman points to an increasing usage of the ‘Audience Needs’ model developed by Dmitry Shishkin to help focus product development, by embracing feedback loops with consumers, and whose ultimate goal is to drill down into specific problems that products can fulfil for readers, increasing their willingness to stay (read more here).

3. Renewal

The renewal stage is a crucial moment, where reminding the consumer of the use of the product through email campaigns and on-site messages can help mitigate churn. If a consumer wants to cancel however, it is key to have a frictionless and painless cancellation process, that nudges users to other products or payment deals to entice them to stay. In a Subscription Economy: A Transformed World we noted that customers are willing to stay if given the right personalised opportunity, namely: 86% would consider accepting a personalised discount, 80% would move to a higher or lower product plan with different features, and 72% would rather pause than cancel. At the FT, we also maintain a “registered” account for ex-subscribers, allowing us to continue to see their interactions with our website and marketing allowing us to maintain the relationship with the customer and make it easier to re-subscribe.

A further challenge can be involuntary churn due to payment failures. It is important to keep a close relationship with payment companies and new fintech solutions in order to help adjust payment timings as well as carefully construct automated customer messaging campaigns to avoid customers churning. At the FT, we have invested heavily on an involuntary churn team that has been able to increase our recovery rate to 66%.

Summary:

Retention is top of mind within our industry in news publishing but also beyond into the wider verticals of subscriptions. Businesses that optimise their retention strategies, with engagement, frictionless user experience, and value-add at the core, will be better positioned than competitors to weather the ‘double whammy’ storm of inflation and a lowering of consumer sentiment.

We have worked with hundreds of news organisations across the world to think more deeply about how to retain their customers (see our case studies). If you would like to discuss the implications of the challenging economic environment on your business - and get advice - please contact Lamberto Lambertini or Tony Leung directly, or via our online form.

About the authors

Lamberto is an Insights Consultant at FT Strategies and supports the ongoing building of media and subscriptions expertise. Prior to joining, Lamberto worked as a Research Analyst at Enders Analysis, where he focussed on the Publishing Industry and the need for radical digital transformation towards reader-first models. He holds an MSc in Media and Communications Governance from the London School of Economics and a Bsc in Politics and International Relations from the University of Bath.

Tony is the Commercial Lead at FT Strategies. Previously he has worked as Commercial Development Manager at CIL Management Consultants, which provided due diligence and strategic consulting to private equity funds, and as a Senior Research Analyst at Preqin, a global B2B information provider to the alternative assets industry.