An interview with Bernard Kpoor, Head of Payment Optimisation at the FT

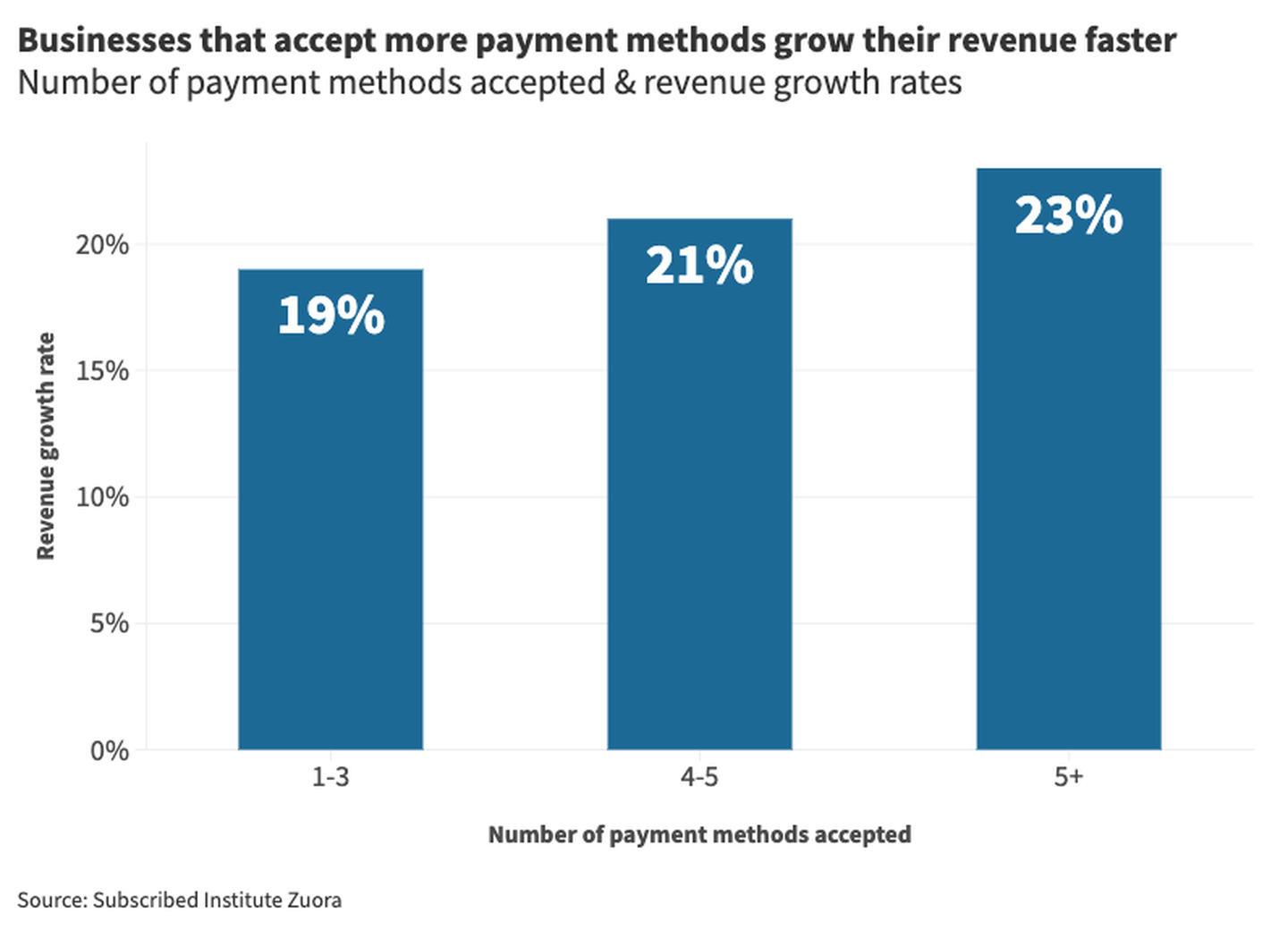

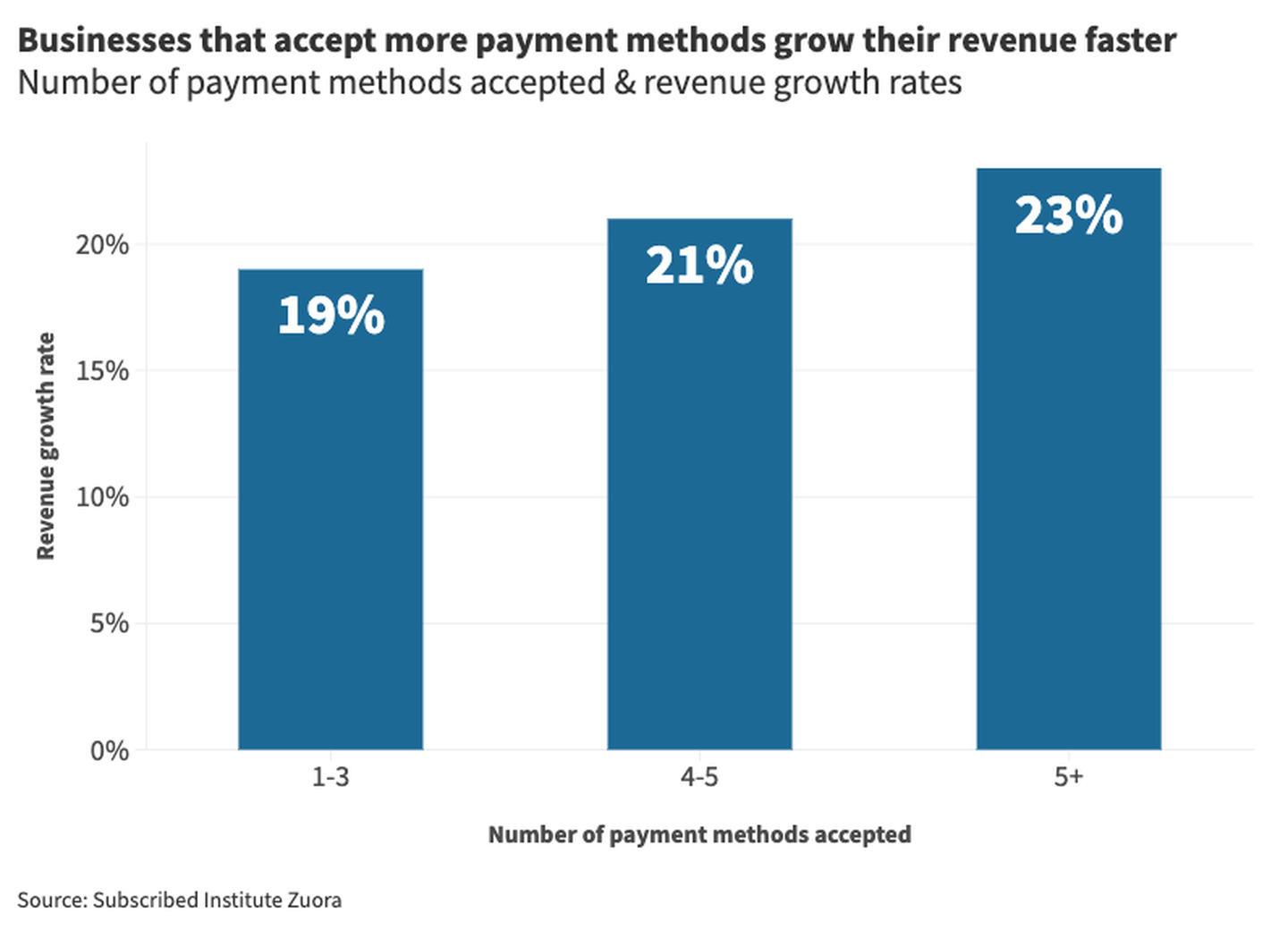

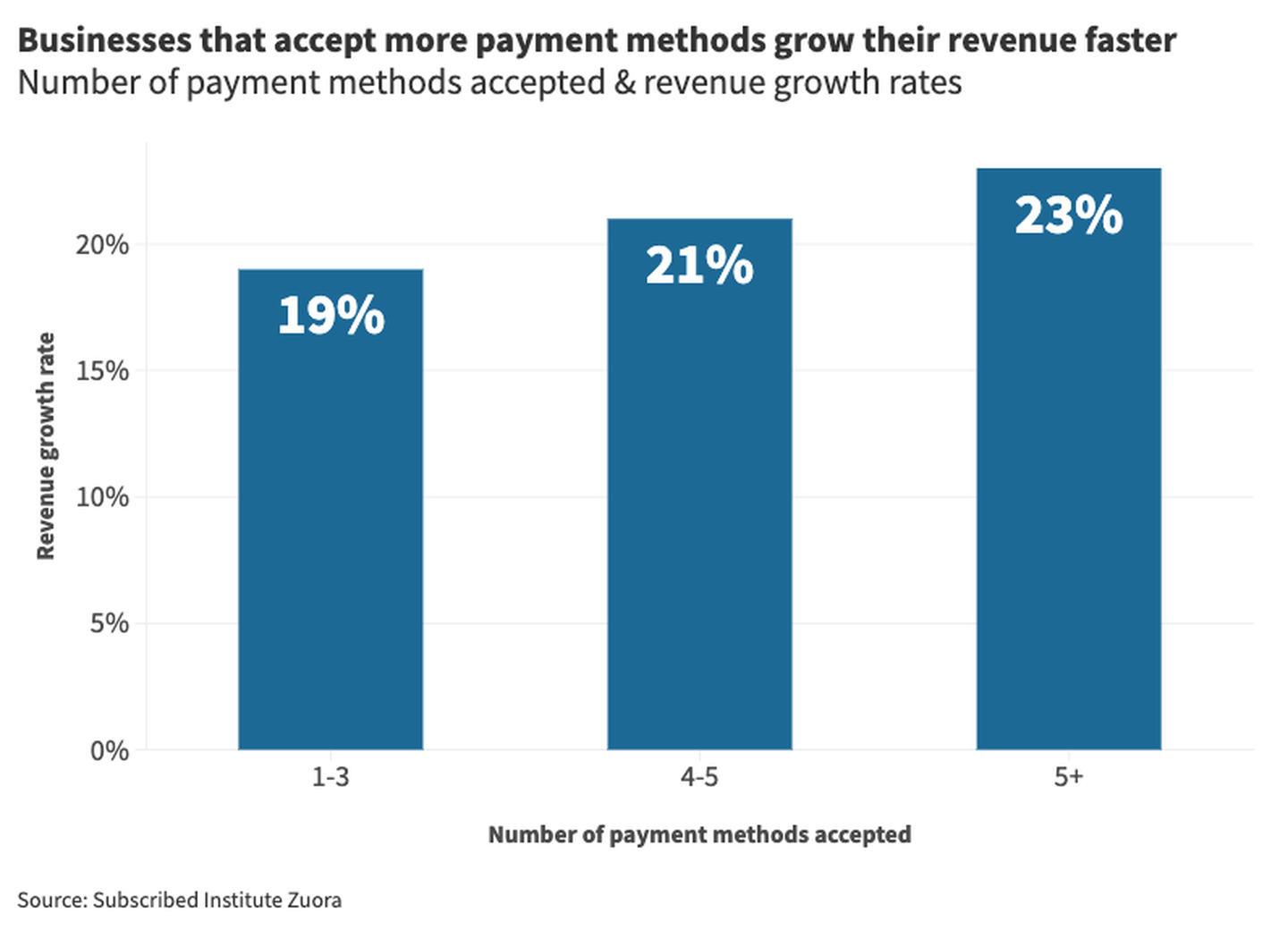

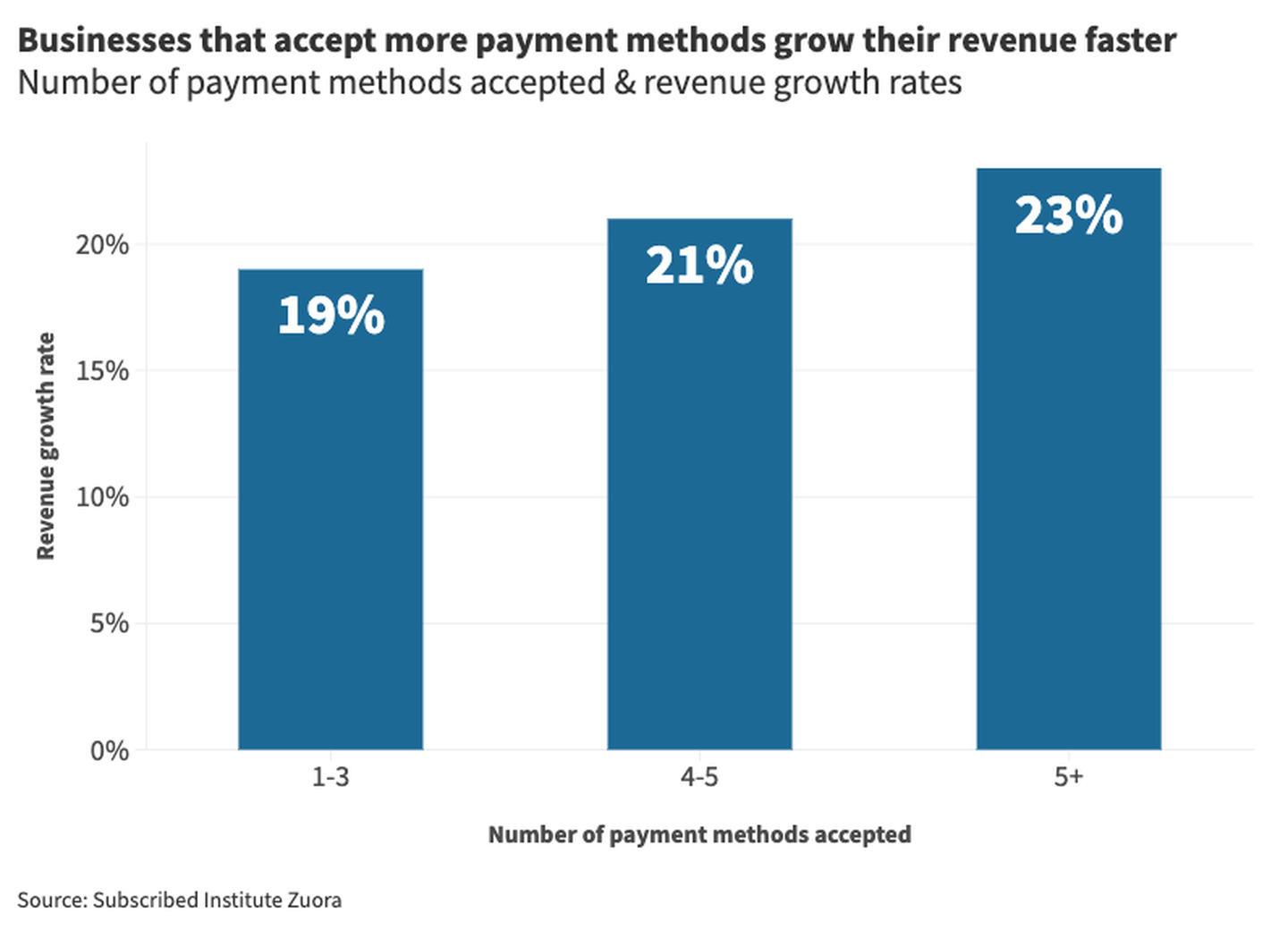

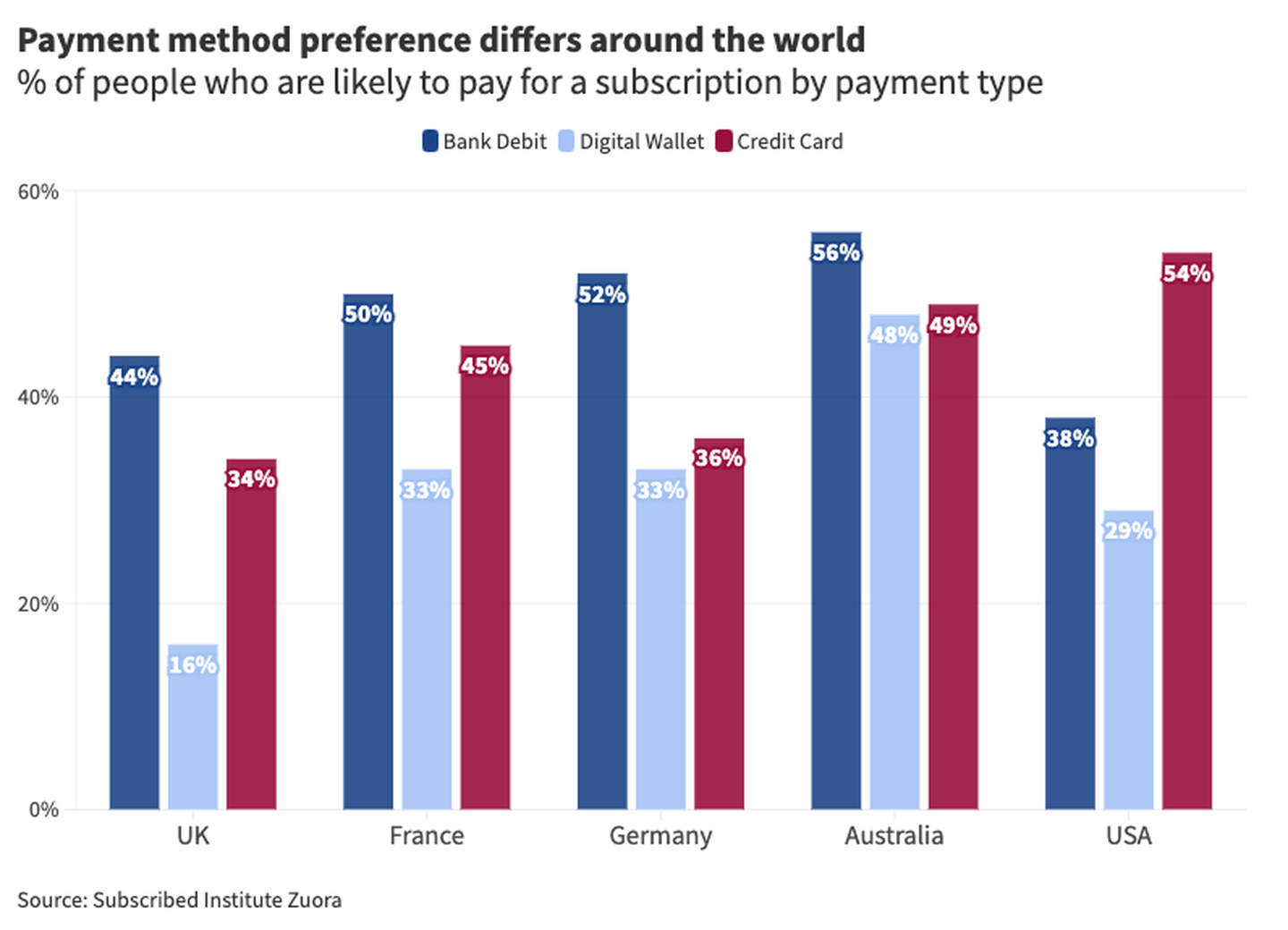

The dreaded payments page is the last step before you convert a reader to your full proposition. Rightfully, much publisher time and resources are spent thinking about how to improve their storytelling and their overall editorial value proposition, but it is increasingly important within a crowded market, to make sure that your payments page is slick, easy-to-use, and acknowledges the different ways that consumers want to pay. Recent research from the Subscribed Institute (Zuora) is particularly interesting. It finds 2 core

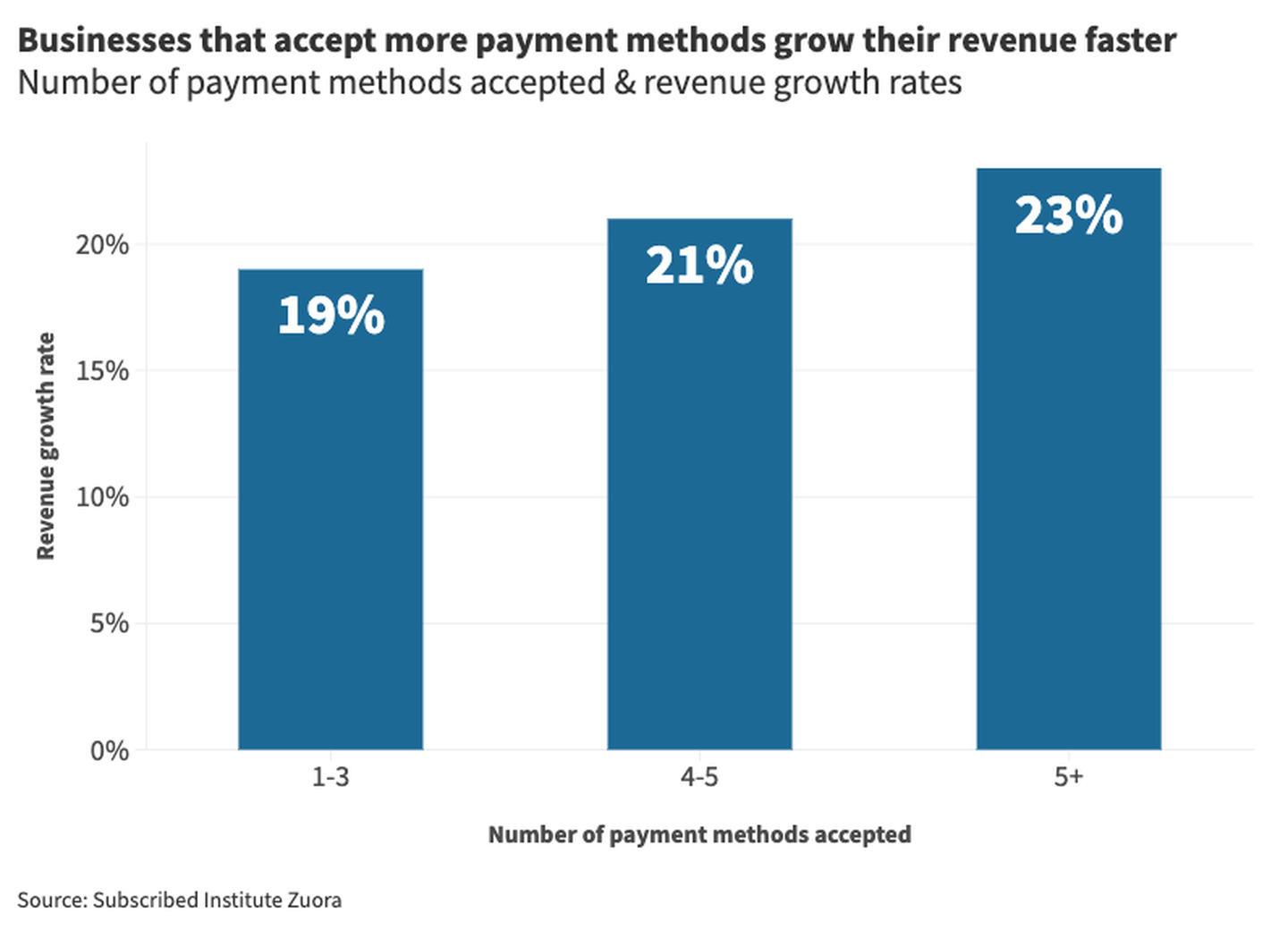

1. Businesses that accept 5+ payment methods achieve higher revenue growth rates than those that accept 1 to 5.

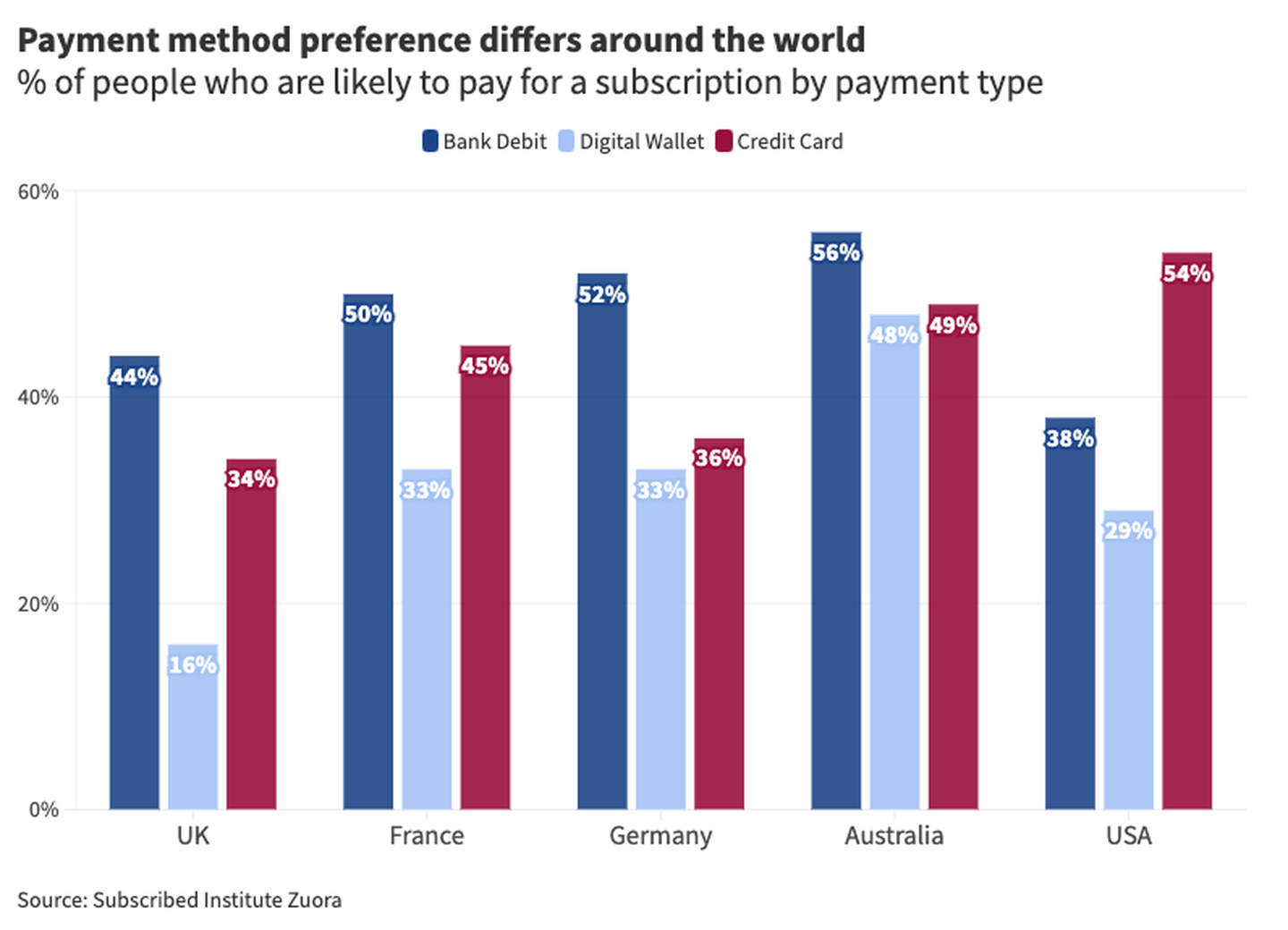

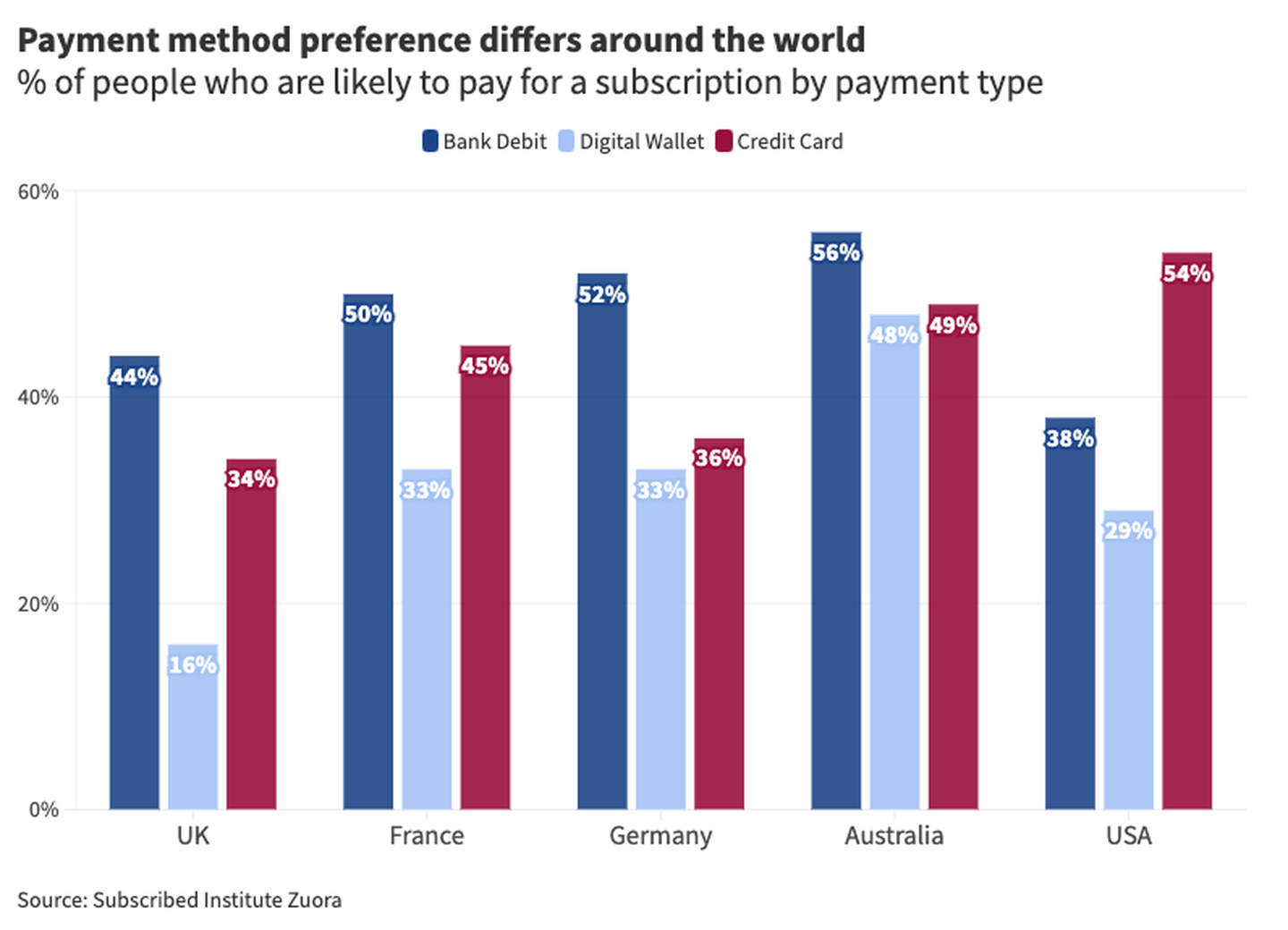

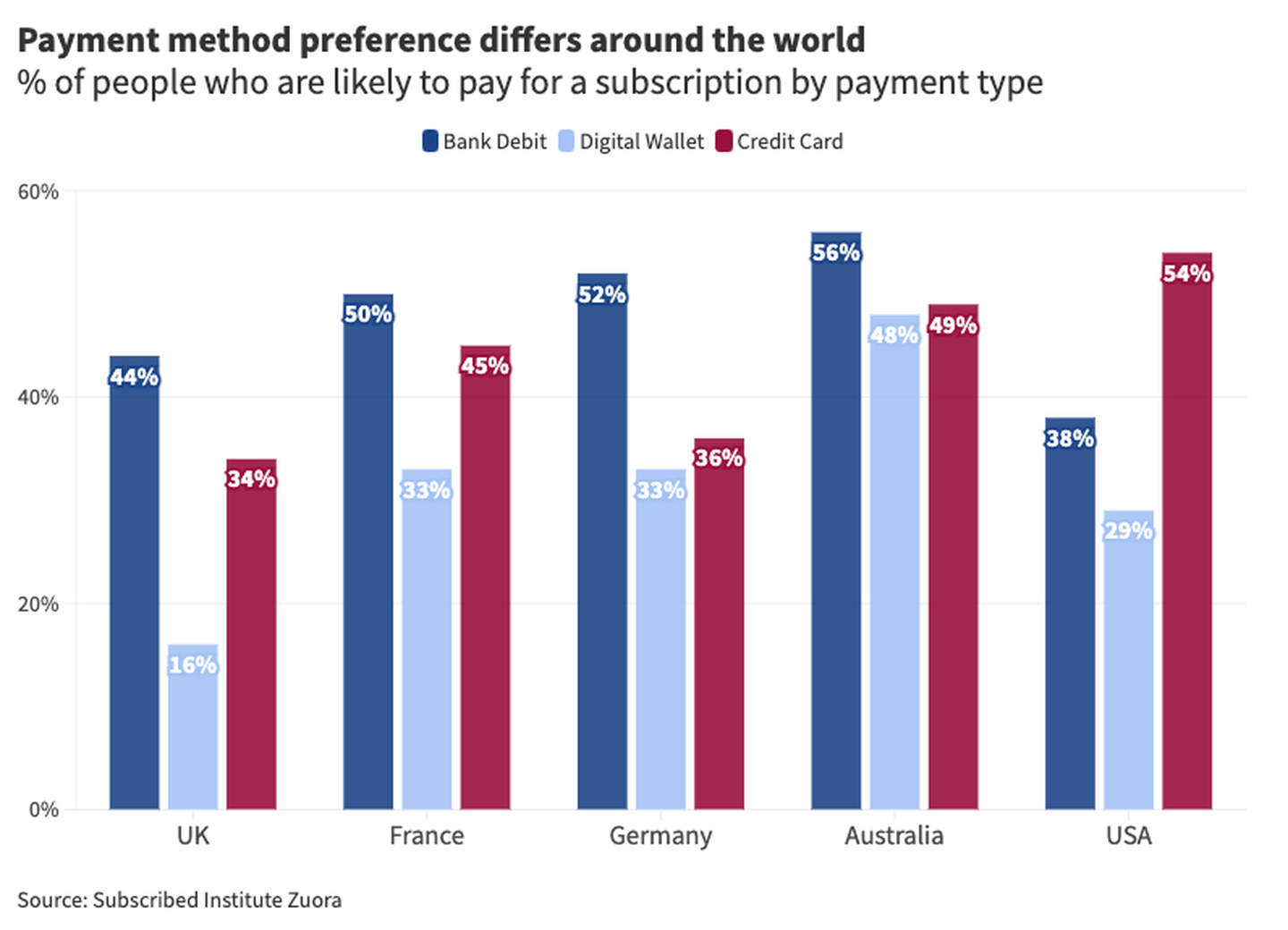

2. Consumers (across all subscription types, not just publishing) have different payment preferences by country

To talk through some of these themes and demystify payments, we talked to the FT’s Head of Payment Optimisation, Bernard Kpoor, who focused on 3 core aspect:

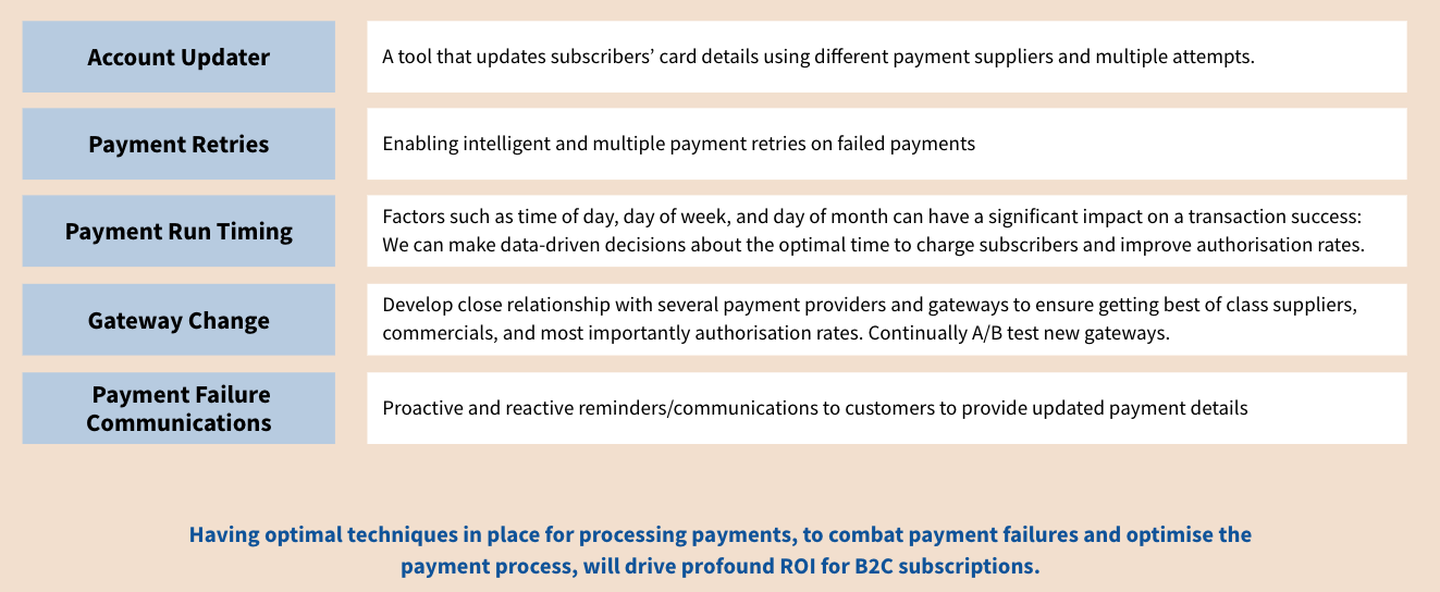

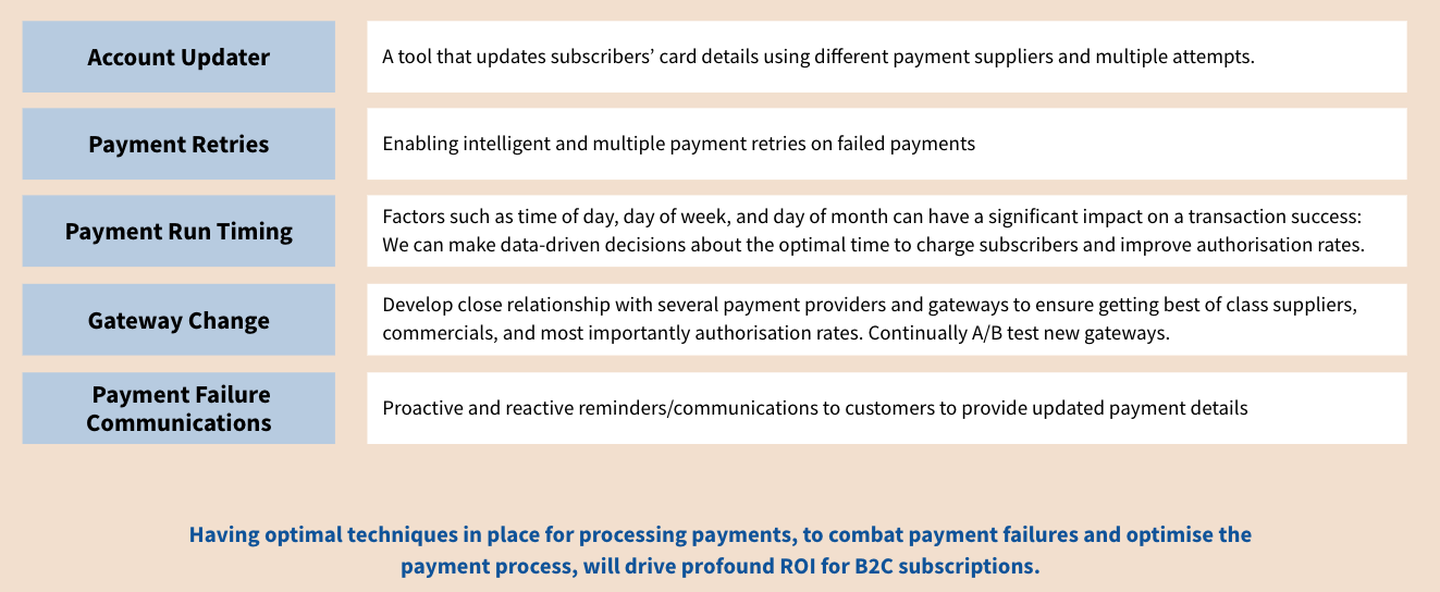

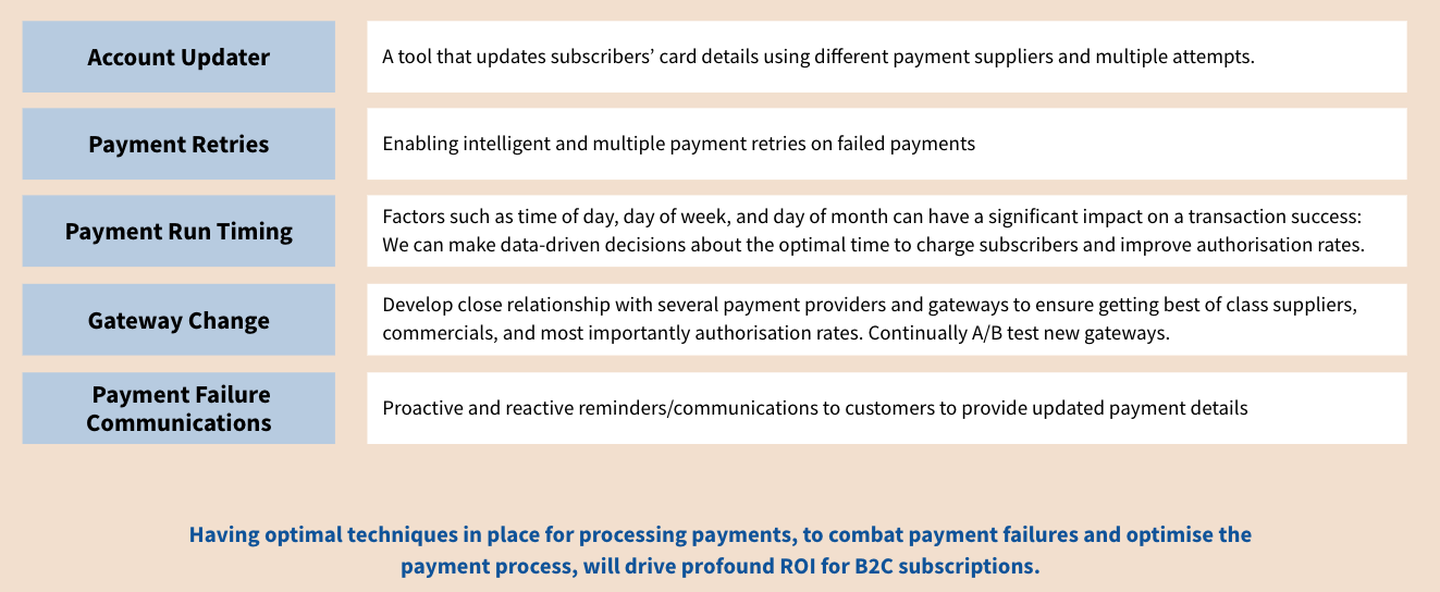

- In the day-to-day, there are 3 core responsibilities for a Payments Optimisation team: Relationship management with payment suppliers, analytics, and keeping up with the regulatory landscape

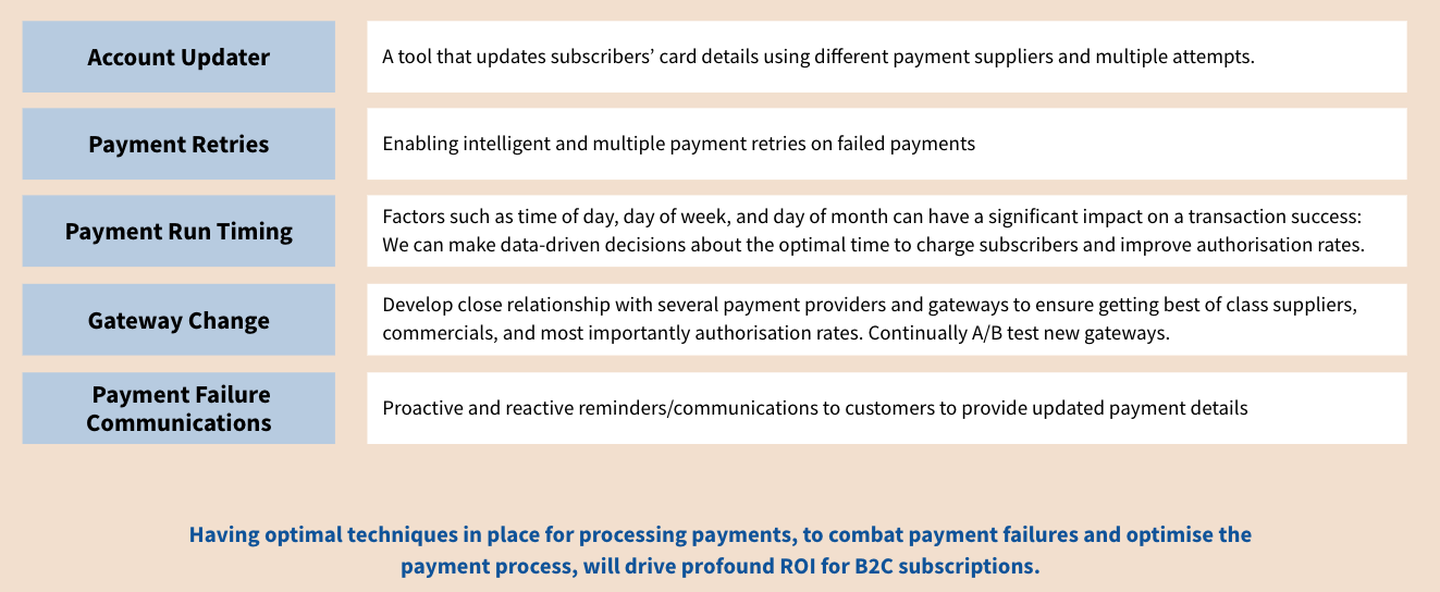

- Tactics to combat involuntary churn include direct and tactical customer contact, account updater systems, automated payment retry, and in the most advanced cases, updating card details through network tokenization

- Ultimately, Payments should be seen as a driver of business growth, rather than merely an enabler

Below you can find an edited transcription of our chat.

Daisy Donald: Hi Bernard, thanks for joining us! Tell us a little bit about what you do at The FT, and what your day-to-day looks like.

Bernard Kpoor: Of course. I am Bernard, Head of Payment Optimisation here at the FT. In the day-to-day, you can break my role down into 3 aspects.

First, there is a relationship aspect to payment optimisation. That means managing the suppliers we use to process our payments. We use a platform with several PSPs (or payment gateways, which are third-party companies that help us accept a wide range of online payment methods), and so it's important to manage their requests for us and vice-versa. I also manage internal relationships like accounts payable, accounts receivable, legal, procurement, and customer care (anyone who has a payment query at the FT, will basically come to me about it, including Product).

The second part is the analytics aspect of payment optimisation. That means going through the data of the transaction that we've processed, and understanding what is working well, what is not working well, why transactions are failing, and what we can do to recover those failed transactions. Ultimately this means the creation of dashboards, keeping them up-to-date and understanding areas of improvement. At the FT, the vast majority of our B2C consumers pay with debit or credit card, followed by Paypal and a growing number of Apple Pay.

Lastly, there is the regulatory aspect of payment optimisation. All card schemes like Visa, MasterCard, and Amex have rules known as card schemes rules, and we have to adhere to those, as well as the PCI DSS (an information security standard) or PSD2 (which requires banks to implement multi-factor authentication for all proximity and remote transactions performed on any channel). Ultimately, it's about staying on top of all the regulations around how you collect recurring transactions, namely: (1) customer notifications of payment collection, (2) terms and conditions. (3) Frequency of payment (4) Amount

Daisy Donald: That’s a great summary. Diving straight into the involuntary churn and the theory around it. What are the ‘categories’ of involuntary churn?

Bernard Kpoor: There are several reasons why payments fail, and ultimately you can get over thirty different reasons for that. Whenever a transaction fails we get a reason code back from the customer's card issuer, and the bank will tell us why the transaction has failed. At the FT, the largest failure reason is insufficient funds (usually when someone sets up a prepaid card to sign-up, and that then fails). There are also multiple other factors: expired cards, errors in the processing of the payment itself, stolen cards, etc. All these reasons are categorised as either:

- Hard declines: where we will not re-attempt the transaction (like stolen cards)

- Soft declines: where we will (by some means) update their payment method, either directly asking the customer or via an account update (like an expired card or insufficient funds)

Daisy Donald: What are some tactics that you use to combat involuntary churn?

Bernard Kpoor: The most basic yet important and successful step is to contact the customer directly. This depends on a lot of things, for example, the trust you have with your customer base or the communication setup within your payment flow (ie: what event triggers a direct email to your customer). We have a retry system that we have built through Zuora, and there are specific rules that we can implement, for example, how many times a day is the retry attempted, the interval, etc. We retry soft declines rather than hard declines. We also have innovative solutions like Network Tokenisation where a card network will automatically update card details (read here to learn more). These are all post-declined tactics that we use.

However, there are also tactics you can use before a transaction is processed. We look through our database to see all cards that are set to expire this month for instance and then put them through an Account of Data request to Visa or Mastercard who then send those files to the card issuers. If a card has expired we should then be able to update those card details. This enables us to not disturb the customer and give them a seamless experience. This depends on the contract with your provider, and depending on that agreement every card that is updated would have a fee. You can build integrations with Visa Net or Mastercard systems to do this process directly yourself, but you need a lot of resources to be able to keep that up. If you are a smaller business, you’re better off doing all this through a third-party payment provider.

Daisy Donald: When does customer care come into play?

Bernard Kpoor: If the email query doesn’t suffice, then a customer can call our customer care and they will then help with anything - including payment. Customer service will be able to help the customer with updating their card details, or if they want to make a payment we can do a MOTO transaction (which stands for Mail Order, Telephone Order) on their behalf within our systems on the call.

Daisy Donald: Let’s talk a bit about the timing of these payment requests. When is the best time to ask for a payment, and how long is the grace period after a payment failure?

Bernard Kpoor: For us, after the first payment failure, you have five days, and when the first retry attempt fails, then the account is suspended. If a customer tries to access their account, they will be notified that there's an issue with their payments and they will be redirected to their account management page to update their payment information. After those five days, we will do 10 total retries, and after that tenth failed attempt, we will cancel the account.

At the FT, our initial transaction acceptance is about 93%, and it is 96% for customers that are paying for the first time. That is quite good in terms of the benchmarks that we look at. For the remaining 7%, we can get 70% of those back as well on the first try. The hard declines are where it is tougher to improve our re-acceptance rates.

Daisy Donald: How has that been tested?

Bernard Kpoor: We are in the process of overhauling our retry system as that has to be constantly updated. The one crucial point about payments is that you cannot simply set and forget a rule. You need to keep looking at your rules and make data-informed decisions on how to go about changing and improving your retention rate by, for example, personalising your rules for different demographics, payment systems, countries, etc. Payment providers will also see things that you cannot see yourself. They will have an MCC code, which is your business category, and benchmark your transactions to other merchants within your industry and tell you tips and tricks.

Another basic (yet key) aspect is making sure you are offering the best and most appropriate and latest payment options for your customers. Apart from Visa and Mastercard, there are alternative payment methods (APMs) like mobile wallets (Apple Pay) or PayPal which are crucial in some markets because debit or credit cards aren’t the most popular payment methods. Direct debits are very popular for our print products, as traditional customers tend to prefer that payment method or are more comfortable with setting those up. There are new methods always popping up that a business needs to be aware of, for example, Buy Now Pay Later (BNPL).

Daisy Donald: There are some countries where recurring payments are difficult due to regulation, can you speak a bit about that?

Bernard Kpoor: Yes. India is one of the big ones where in 2021 the Reserve Bank of India (RBI) brought out new legislation on recurring transactions that have made the landscape more tricky. What has passed essentially is Merchant Initiated Transactions (MITs) as opposed to our system called CITs where customers click the payment button and that’s it. With MITs, you need to request the customer to authorise a recurring payment (effectively making it various payments rather than a ‘recurring’), which brings a lot of friction in the payment process.

That is why, at the FT we also have a variety of PSPs (payment providers). The reason behind that is that domesticity is really important, in that, having a local partner with an acquiring licence is very important to approve transactions for example in the USA. Different PSPs also have different fraud rates, so you can also switch constantly who you are using.

Lastly, I ultimately think that historically, payments have been a business enabler rather than a business driver, never really being part of the strategic considerations for a business. By thinking creatively about payment options, as well as gathering insights about people’s payment preferences and habits, you can help understand how to upsell or cross-sell to your audience, ultimately leading to greater revenue and a closer relationship with your audience.

Daisy Donald: Bernard, thank you so much for your time!

Bernard Kpoor: Thank you!

About the Authors

Daisy joined FT Strategies from Reuters where she was Director of Global Customer Experience overseeing their website and reader revenue. Before that, she spent over eight years leading customer research teams in London and New York at the Financial Times and beyond, working closely with the B2B sales and product teams to define key strategic research initiatives. She has an EMBA from the IE Business School, Madrid.

Lamberto is an Insights Consultant at FT Strategies and supports the ongoing building of media and subscriptions expertise. Prior to joining, Lamberto worked as a Research Analyst at Enders Analysis, where he focussed on the Publishing Industry and the need for radical digital transformation towards reader-first models. He holds an MSc in Media and Communications Governance from the London School of Economics and a Bsc in Politics and International Relations from the University of Bath.

.jpg?width=768&name=928414120.jpg__1440x500_q90_crop_subsampling-2_upscale%20(1).jpg)