Pricing is a crucial piece of the digital subscriptions puzzle

Profitwell, a SaaS business providing revenue operations products found that monetisation has nearly 8X the impact of acquisition. Despite that, the five thousand companies surveyed for their report typically spend less than 10 hours per year on pricing. At FT Strategies we believe that everyone can benefit from some dedicated time working on their pricing strategy. We’ve put together these tactics – based on experience working with publishers and other subscriptions businesses – to help you make practical steps towards pricing success.

1) Find the pricing sweet spot of your customers with the Van Westendorp Model

Picking the right price point is the most important starting point. Three common methods for determining a price point are: cost-plus, competitor based and value-based. Cost-plus takes the total cost of producing your product and adds an amount to allow the business to make a profit. Competitor-based sets a price based on what competitors are charging, usually either by slightly discounting or adding a premium accounting for the value of your product or brand. Value-based pricing seeks to define a price based on the value that your product can deliver to your customers.

The consensus among most pricing experts is that value-based pricing provides a win-win for customers and businesses, particularly for digital subscription businesses. Value-based approach incentivises you to think in a customer-centric way: your ability to raise prices is linked to your ability to add value to consumers.

The first step towards establishing a price point is to understand your customers, typically through market research. While it can be tempting to directly ask customers what their preferred price point would be, more sophisticated methods allow you to remove some of the bias from this approach. One of our preferred strategies is the Van Westendorp Price Sensitivity Model, which allows you to build an understanding of what potential buyers limits are. It starts with a simple survey, introducing people to your product before asking the following questions:

- At what price would it be so low that you start to question this product’s quality?

- At what price do you think this product is starting to be a bargain?

- At what price does this product begin to seem expensive?

- At what price is this product too expensive?

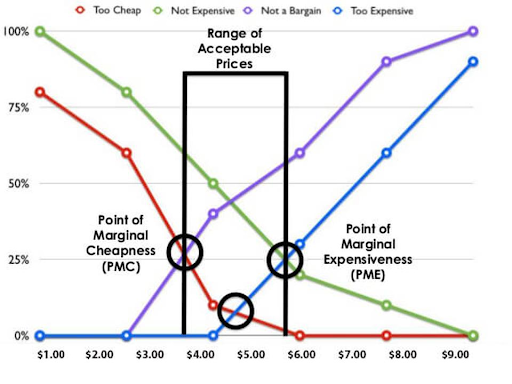

From here, you visualise the results on a line graph with price on the x-axis and the number of respondents on the y-axis (see below). For each question, plot a line using the cumulative number of people who answered at each price point – leaving you with four lines in total.

According to the model, the intersections of the line provide some useful insights:

- Point of Marginal Cheapness = intersection of the number of people who think that the product is “too cheap” and “not a bargain” [Lower bound]

- Point of Marginal Expensiveness = intersection of the “too expensive” and “not expensive” lines [Upper bound]

- Optimum Price Point (OPP) = the intersection of the “too cheap” and “too expensive” lines, and will be located between the Point of Marginal Cheapness and Point of Marginal Expensiveness

According to the model, this price is the optimal price because it minimizes the number of people who are dissatisfied with the price of your product one way or the other.

Of course, there are many other specific approaches to establish a value-based price. The main takeaway is to put your customers at the heart of your approach.

2) Use segmentation to test price sensitivity among customer cohorts

Segmentation is critical at all stages of the subscriptions lifecycle, from acquisition to retention. It’s also at the heart of our pricing strategy. For example, the FT recently ran a pricing survey for five cohorts that had been identified based on demographics and reading preferences. The five segments were:

- Professional Readers

- Opinionated Newshounds

- Objective Deep Divers

- Aspiring Mainstreamers

- Bite-size Browsers

The survey results provided some fascinating insights. For example, Objective Deep Divers were willing to pay less than half the price of Professional Readers. These Objective Deep Divers differ from Professional Readers in that they aren’t looking for specialist markets and finance data, or breaking news. They want detailed, objective analysis of political stories. Rather than lose out on this potential audience by pricing too high (or lose out on potential revenue from Professional Readers by pricing at this lower level), the FT saw an opportunity to offer a variation of the product at a lower price (i.e. a specific subscription tier). At the same time, this audience can be offered distinct marketing messages, positioning the FT as a place for objective and impartial news (e.g. “Don’t settle for black and white”).

3) Get creative with tiers to offer something for everyone

Once you have identified segments and relative price points, best practice is to use tiers to maximise your reach (while attempting to reduce the risk of cannibalisation). The Good-Better-Best (G-B-B) approach to pricing has been popular with businesses from many sectors, stretching back to General Motor’s “price ladder” implemented by Alfred Sloan. Sloan’s idea was to create ‘a car for every purse and purpose’, creating five non-competing brands that increased in price (from cheapest to most expensive: Chevrolet, Pontiac, Oldsmobile, Buick and Cadillac).

Similar approaches are becoming commonplace within the subscriptions space. For example, LinkedIn has four premium options based on customer profiles that have very distinct needs. Each option has a different price due to differences in willingness-to-pay. However, the actual product is similar across all purchase options.

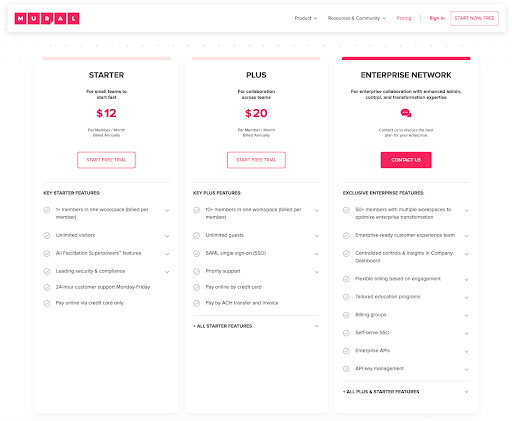

Like many SaaS businesses, virtual whiteboard collaboration app Mural offers three choices to frame decision behaviours. A starter tier allows price-conscious individual customers and small businesses to access and experience a simplified service for a low cost. A plus tiers offers improved features and priority support. Meanwhile, larger businesses have an enterprise tier that unlocks features that are likely to be required by corporates (e.g. centralized controls and company dashboard).

If your product has niche functionality for a segment of users, you might be able to create a more narrowly defined tier at a distinct price point. For example, The New York Times provides specific content access in order to reach specific segments of readers. For example, you can subscribe to receive the crossword for £25/year (a fraction of the cost of a full subscription). A similar offer is available for subscriptions to NYT Cooking.

When adopting a tier system, it is worth noting that studies frequently show that people will typically choose the middle option when presented with three choices – so like LinkedIn, you may not need to create radically different experiences in order to help people make a decision to commit at a specific price point. The best strategy to optimise your tiers is to test your assumptions with discovery interviews and quantitative experiments.

4) Use smart discounting to drive Lifetime Value

Discounts can be a great way to maximise value, but it’s vital to measure the longer-term impact of this approach. Many subscription businesses will guide discounting decisions using a Lifetime Value metric. In this way, you can ensure that discounts make sense for your business as well as your customers.

One of the most effective discounts is to sell annual plans at a discount relative to monthly plans. This usually pays off in terms of Lifetime Value because Annual plans reduce churn by reducing the opportunities to cancel (from once a month, to once a year). Writing in Digiday, paywall provider Piano reports that after one year of subscribing to a news product, only 45% of monthly subscribers are left at the end of that year vs. 75% of annual subscribers. Based on those numbers, it can make long-term financial sense to price annual plans at very steep discounts (as much as 30%).

When it comes to growth, trials can be an effective vehicle to demonstrate your product’s value. Most experiments have shown that charging a nominal fee is far more effective than offering a completely free trial. For example, Piano found that even at a low price (e.g. £1) paid trials retain 81% after the trial period, compared to 70% for free trials. After one year, 41% of those acquired via paid trial were retained versus 25% for free trials.

The Boston Globe made a bold bet on long-term sustainability by radically extending the length of their free trials, with impressive results. During a one day sale, the Globe offered a 6 month trial for $1 (vs the usual offer of a four-week trial 99c per week). This offer attracted 1,728 subscribers in 24 hours. At the same time, the Globe invested in an improved onboarding experience for these subscribers, encouraging them to engage more deeply with newsletter subscriptions and by downloading the app. Subscribers on this new offer had a conversion rate 10x higher than those joining via the shorter trial. Tom Brown, Senior Director of Consumer Revenue, explained why the initiative was a success: “We think we removed anxiety from thinking about having to cancel a subscription early on. We gave people a risk-free way to sample it for six months.” (see INMA’s “Subscription Pricing: From COVID Bump to Sustainable Revenue”, April 2021)

Other discounting tactics might include seasonal discounts during quieter months, for example, or offering a discount as part of a referral scheme. Regardless of the approach, monitoring the long term impact on Lifetime Value is critical.

5) Once you’ve acquired customers at a discount, develop a personalised journey to RRP

Once someone has been acquired at a discount (e.g. 33% RRP), it might be tempting to keep them at that price. However, businesses that do this miss out on well-earned revenue. Providing customers are finding value in your product, you should try to bring them in line with your standard price over time.

A one-size fits all approach would see you start at 33%, then move to 25% at a fixed renewal interval (e.g. after 3 months). Subsequently, you could shift to 10%, followed by moving the customer to RRP. While this approach is perfectly valid, a more sophisticated technique being explored by many subscriptions businesses is to make dynamic “rightsizing” decisions for individual customers based on their usage or circumstance. For example, you could experiment with using engagement and usage to offer disengaged users a save offer (e.g. a discount or downgrade). Meanwhile, your more engaged users could be given a faster journey to RRP (or be recommended an upgrade to a more premium tier).

How FT Strategies can help

Over the past 18 months, FT Strategies has helped a number of businesses effectively approach the challenge of monetisation. Pricing is critical – and can have an outsized impact on your business’s long term sustainability.

We’d be delighted to hear from you if you are rethinking your approach to pricing. We have worked with all sizes and shapes of business in various formats – from 2-week design sprints through to longer-term engagements. And as ever, we’re always happy to start with a chat over coffee.

About the author