The retail sector is poised between two sets of challenging circumstances. Looking backwards, the dust has broadly settled from the pandemic. Retailers are now observing the extent to which the online shopping behaviours that rocketed in lockdown persist, grow or slow in the coming years.

Looking to the future, retail faces a fresh set of challenges. The World Bank’s publication Global Economic Prospects paints a grim picture. War in Ukraine has led to ‘global effects on commodity markets, supply chains, inflation, and financial conditions’ leading to the possibility of stagflation: ‘stubbornly high global inflation accompanied by tepid growth.’

At FT Strategies, we believe that the best way for retail businesses to thrive at this challenging time is to build customer-centric businesses. Now is the time to adapt your proposition, products and technology to meet the changing needs of your audience. This blog post covers three trends we’re following in the retail sector.

1. The subscription model continues to grow, but retailers should beware ‘box fatigue’ and consider that not all businesses are well-suited to it

Over the past decade, the subscription model has steadily established within the retail sector. A generation of new entrants has made it possible to subscribe to snacks (e.g. Graze), meal kits (e.g. Hello Fresh), toiletries (e.g. Dollar Shave Club), wine (e.g. Naked Wines), and much more. During the pandemic, subscription ecommerce experienced massive growth. Sales grew a massive 41% in 2020, with eMarketer forecasting that growth would continue at a lower (but still impressive) 17% into 2023.

But subscriptions are not a silver bullet. 2022 has seen several fashion subscriptions startups facing the challenge of ‘box fatigue’. In May, Nordstrom closed Trunk Club, a personalised clothing service they acquired in 2014. Meanwhile, personal styling service Stitch Fix are reportedly losing money and customers. Some traditional retailers that have dipped their toes into subscriptions have also faced challenges. Digiday reports that JCPenney dropped its clothes subscription due to limitations in total addressable market size and churn. There are signs that boxes make more sense in specific situations: for niche products, for example, or for retailers that can draw upon a wide inventory (e.g. department stores).

Subscriptions are likely to suit some businesses better than others. FT Strategies can help you identify whether the model is appropriate for you, and optimise your approach.

2. Changing consumer attitudes about sustainability, affordability and waste are leading more brands to explore re-commerce marketplaces

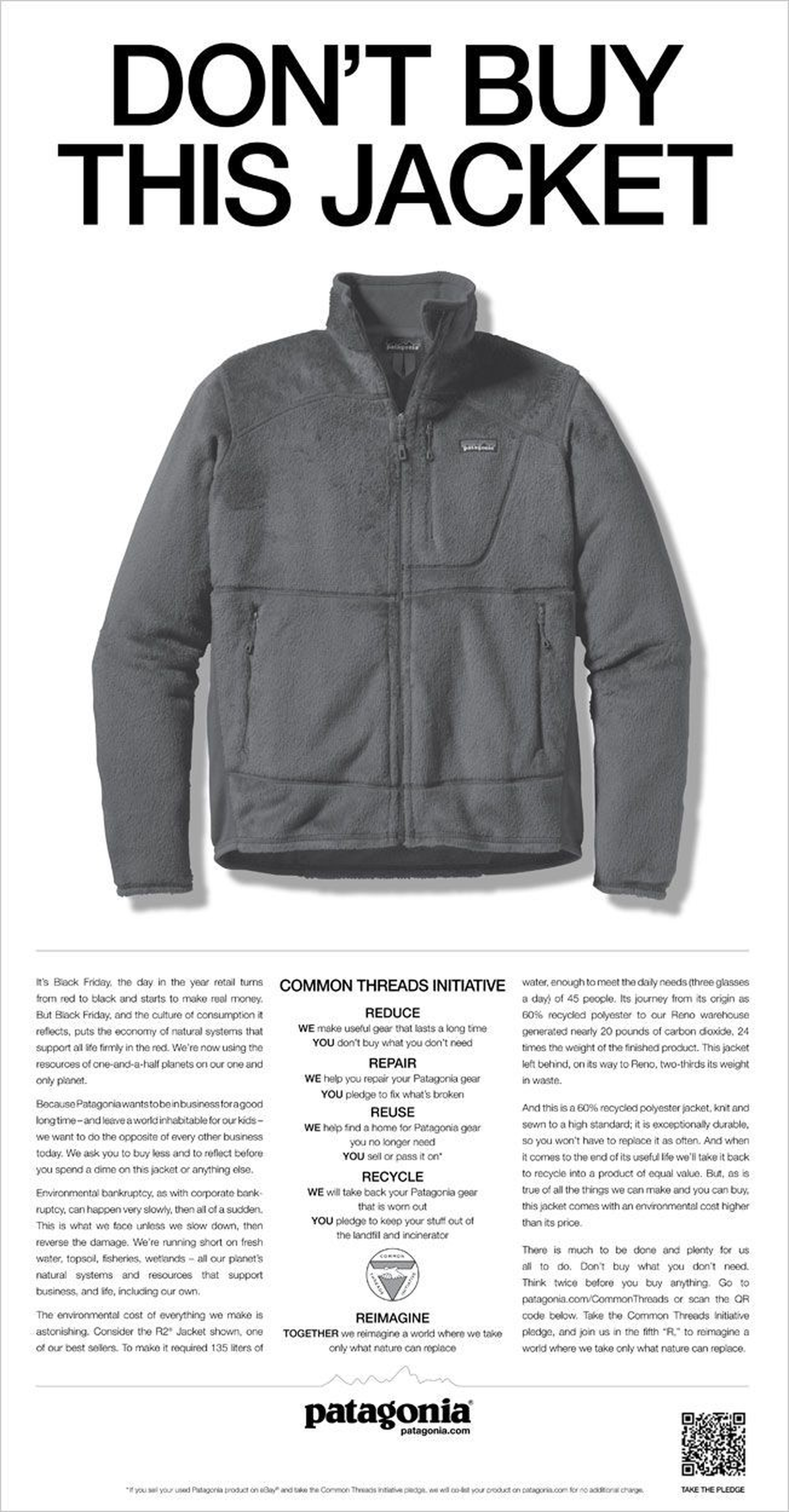

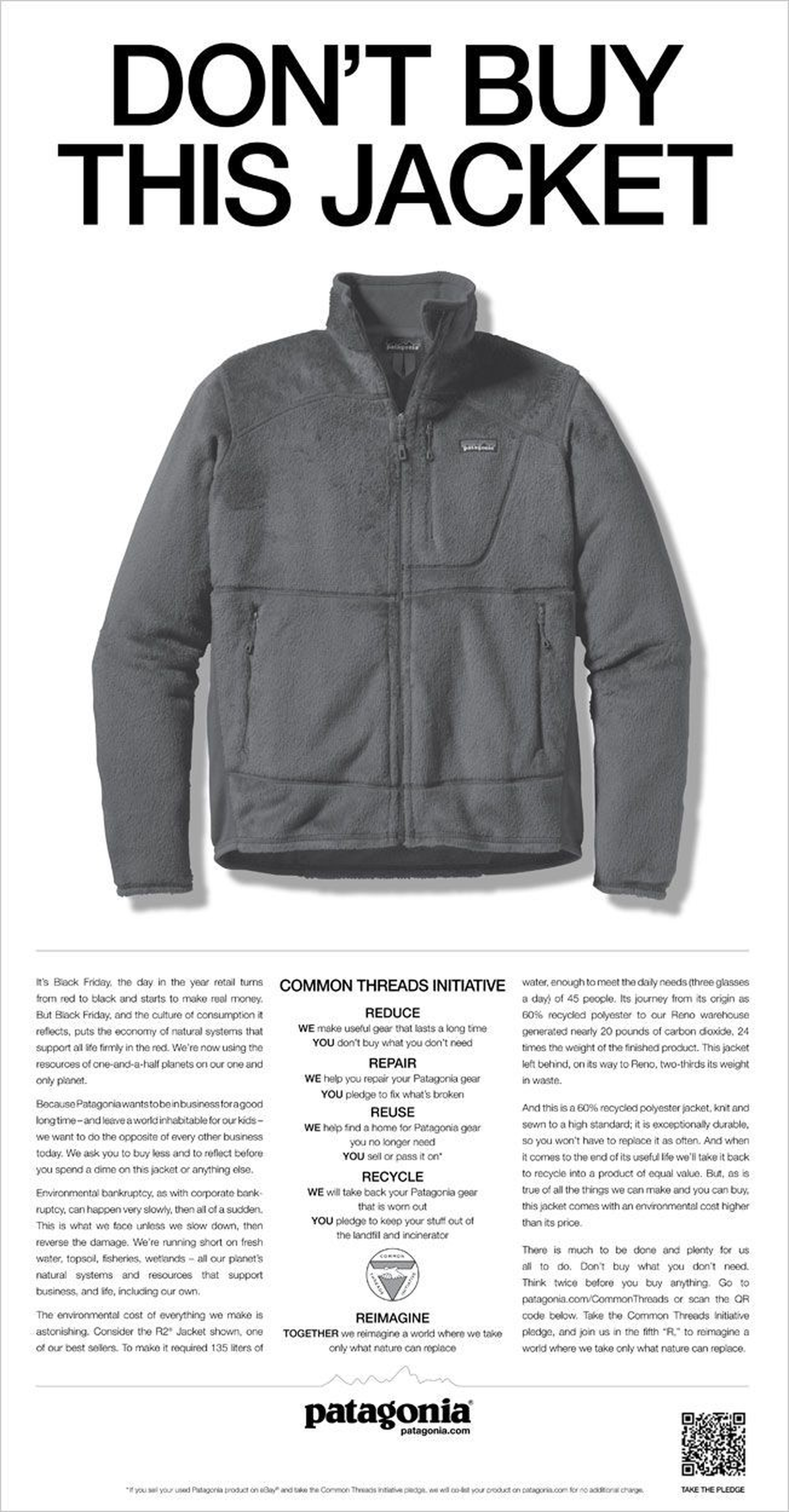

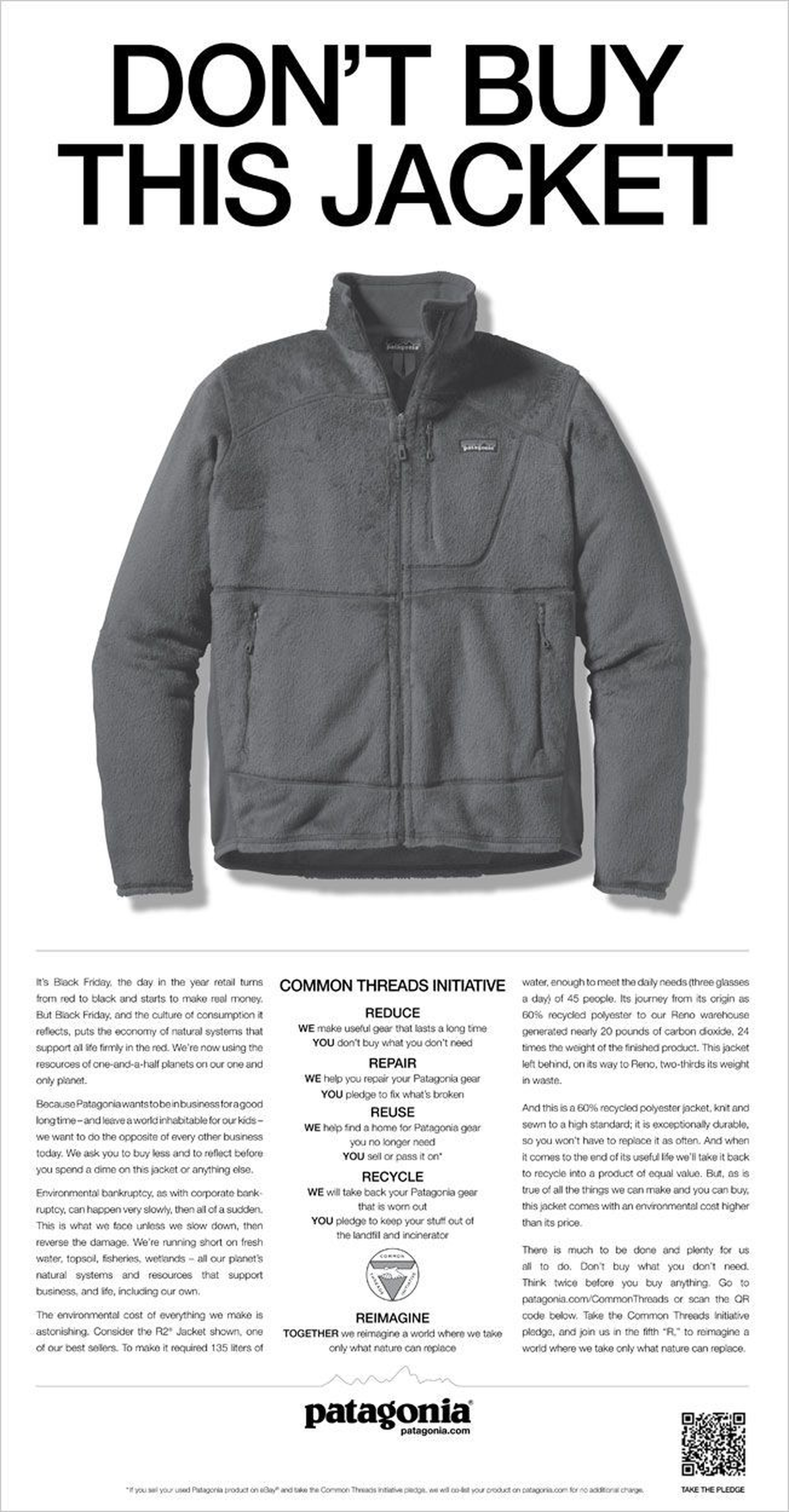

Over a decade ago, eco-conscious fashion brand Patagonia published a daring advert on Black Friday. Above a picture of a Patagonia jacket, written in large capital letters, was the phrase: ‘DON’T BUY THIS JACKET’. In the smaller copy below, the company explained the huge environmental costs involved in the production of a single item of clothing, and implored readers to ‘Reduce, Repair, Reuse, Recycle’.

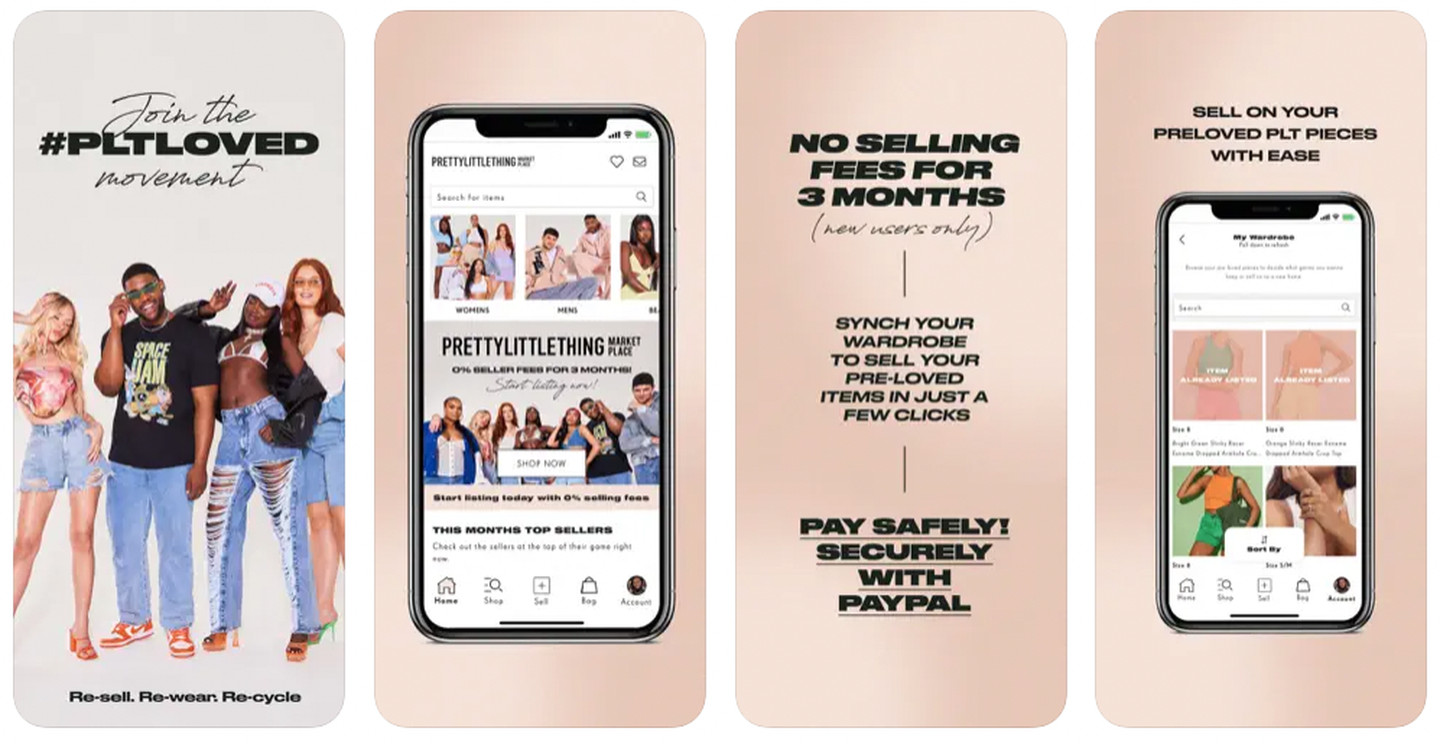

At the time, Patagonia felt like a brave outsider in the retail and fashion worlds. But consumer attitudes are changing. WeForum reports that three-quarters of Generation Z survey respondents would prefer to buy on the basis of sustainability, rather than brand name. It’s interesting to see that fast fashion brand PrettyLittleThing launched a resale marketplace in September 2022. The marketplace is billed as a ‘buying and selling community allowing you to sell on the clothes you no longer wear or buy & shop for something new to you… focusing on the ‘The 3 R’s’; re-selling, re-wearing and re-using.’

But this isn’t just about saving the planet. Andy Reuben, founder of Trove (a tech company that powers reselling for PrettyLittleThing and other brands), explained on a Walton College podcast: ‘Why would you only sell an item once when you can sell it seven times.’ There are plenty of parallels to this outside of retail, such as Ticketmaster’s recent move into the secondary market by reselling event tickets.

There has always been a market for consumers reselling goods. What once took place exclusively at flea markets and thrift stores, started to move online in the 1990s with websites like eBay and Craigslist. We believe that now is the time for all retailers to consider leveraging commercial opportunities presented by growing consumer interest in sustainability.

3. Technology continues to raise the consumer expectation for convenience, but Quick Commerce doesn’t have all the answers for last-mile grocery deliveries

The past years have also seen the rise of on-demand retail, driven by the changing expectations of ‘generation now’. In many markets, the pandemic saw a dramatic increase in demand for ‘Quick Commerce’ startups like Getir and Gorillas. Initial growth in these businesses led some commentators to prophesy the demise of the corner store.

However, as most economies have started to ‘re-open’ there have been reports of a contraction in the Quick Commerce market. In part, this is due to the low-margin nature of groceries. Retail expert Quaid Combstock has said: ‘The pandemic created a warped vision of the way people were going to buy their groceries in the decades to come … when people could go out safely, the need for on-demand grocery receded. This is what the rapid delivery firms and their venture capital backers got completely wrong.’ Combstock believes that the profit margins on last-mile grocery delivery are too low for these new businesses to ever turn a profit.

The sector is also seeing regulation catch up with the more disruptive aspects of these businesses. In Amsterdam, the city council is closing several ‘dark supermarkets’ for violating zoning plans.

So what is the alternative to last-mile grocery delivery? Unstaffed frictionless grocery shopping has shown some promise in recent years, and is typically found in urban population centres. Amazon Go, for example, currently has stores in Seattle, Chicago, San Francisco, New York City and London.

Livfs is a Swedish grocery chain that believes unstaffed groceries can also bring convenience to sparsely populated rural communities. The business was set up to fill the gap created when smaller shops go bust in areas not served by supermarkets. Founder Daniel Lundh told Grocery Dive that ‘to be able to survive on a much lower customer base, we needed to be able to control our cost of operations to at least keep some margin and have a price point that’s acceptable for the consumer’.

The solution was to lean into technology to manage stock and handle transactions. Customers use a smartphone app to access stores, scan goods and pay. App usage is monitored for unusual behaviour (e.g. entering and exiting without paying), and any suspicious activity is flagged and then checked on CCTV. The shops in Livfs’ network provide staples like milk and bread 24 hours a day, and prices are kept low because they are unmanned. Their first store was opened in Bålsta in 2019, and by late 2021 the chain had reached 27 locations.

Livfs has gained a deep understanding of a particular segment’s needs. It met those needs by harnessing existing technology in a novel context. FT Strategies can help your business embrace an experimental customer-centric mindset, in order to make the most of your technology investments.

FT Strategies can help your business prepare for tomorrow’s opportunities

At FT Strategies, we work together with you to exceed your ambitions by delivering a sustainable growth strategy built upon leading-edge capabilities that improve your customer engagement, retention, revenues and profit. We have developed a reputation for powering customer growth through creative and dynamic digital transformation strategies from conception to execution.

We would be delighted to hear about the opportunities at your retail business. So please do get in touch with us if you’d like to continue the conversation.